June 10, 2024

By Dan Carrigan for VADA.com

The auto industry is still throwing quite the shindig in 2024 – but this year there’s a fair share of party crashers trying to stir up the dance floor, a Cox Automotive executive told dealers at VADA '24 today.

Cox Automotive's Brian Finkelmeyer takes to the podium in a general session at the Virginia Automobile Dealers Association annual convention on June 10, 2024 at The Wild Dunes Resort on Isle of Palms, S.C.

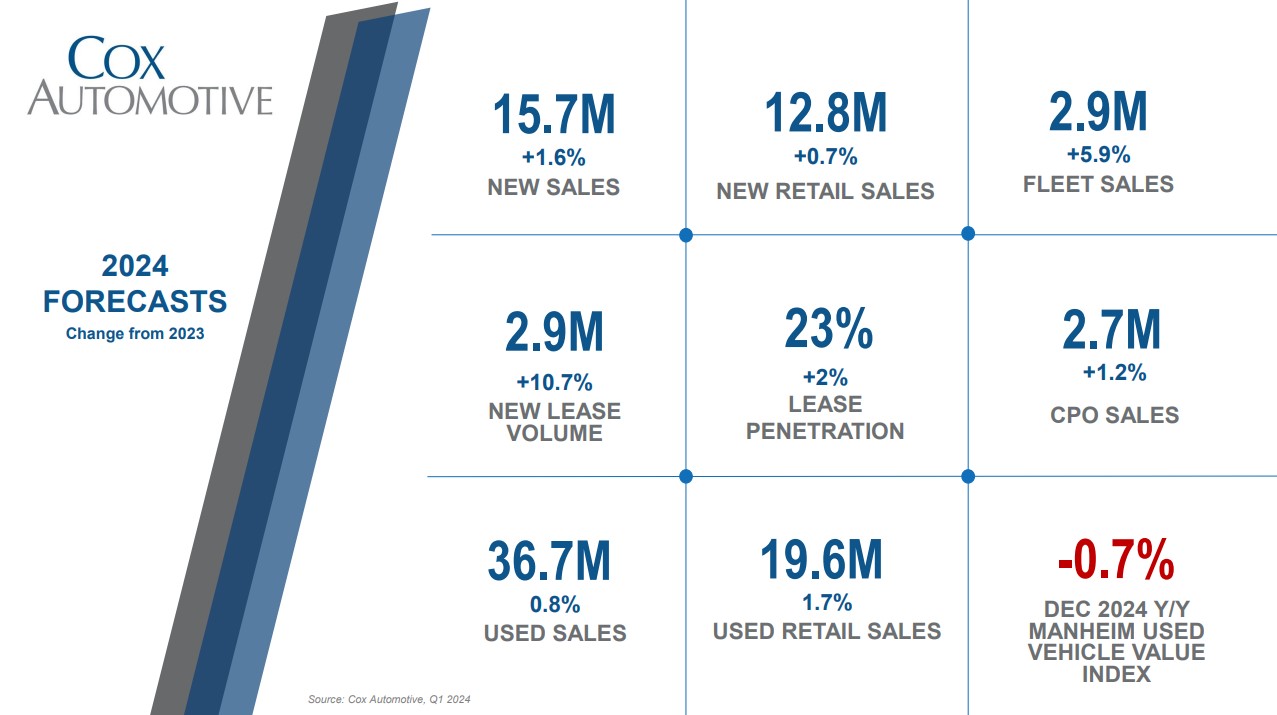

Both new and used car sales have revved up by 3%, proving that even amid rising costs, the party's still going strong. Dealers just need to watch out for some uninvited guests shaking things up, said Brian Finkelmeyer, senior director of Cox Automotive’s Enterprise Insights and Advisory practice, to attendees in a general session at the Virginia Automobile Dealers Association’s annual convention on Isle of Palms, S.C.

“We've got some party crashers that are influencing our business today,” he said. “That's inherent in business. There's always going to be challenges we need to overcome.”

Party On

In addition to strong sales performance across new and used vehicles, the auto industry's profitability continues to shine. Average MSRP fees are up around $49,000, Finkelmeyer said, compared to pre-pandemic levels of about $36,000. Yet, dealers are still seeing strong returns, ”although we're not quite at the peak” of the “raging party” of 2022 profitability, 2024 is still well ahead of pre-pandemic levels.

A significant factor in profitability is the industry's ability to adapt.

"The industry has really figured out a way to make significantly more money selling less cars because of this mix issue that we've seen take place for the last three years," he noted. This strategic shift has allowed dealers to maintain solid margins despite lower volumes.

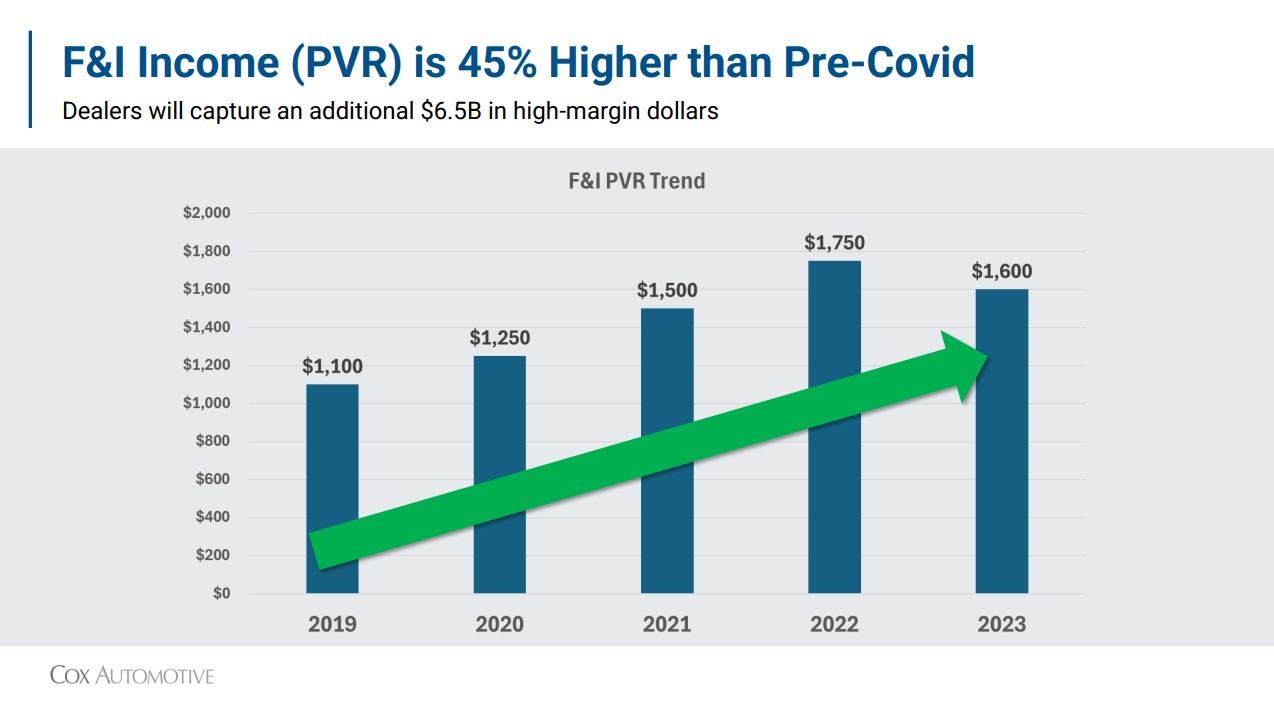

Finance and insurance (F&I) operations have also been a major contributor. "In 2019, the average per vehicle retailed (PVR) was around $1,100, and today we're sitting at $1,600," Finkelmeyer explained. PVR measures the average amount of profit a dealership makes on each vehicle sold.

Overall, a $500 increase per car has resulted in "roughly $6.5 billion of additional high-margin revenue flowing through operations,” he said. “That’s definitely been a pretty favorable tailwind for dealers across the country," underscoring the industry's savvy in leveraging F&I to boost profitability.

CarMax and Carvana Have A Reason To Celebrate

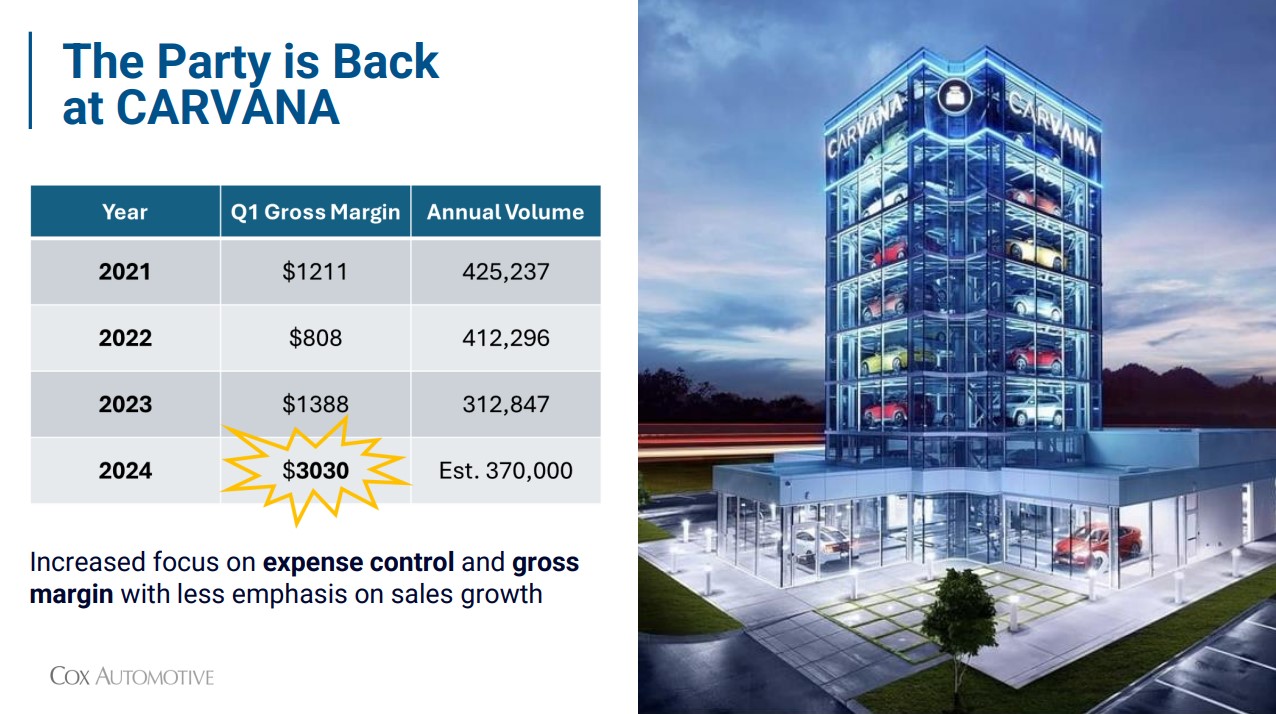

One of the more compelling narratives in the automotive industry involves the remarkable turnaround at Carvana, Finkelmeyer said.

"I was really taken aback to see that that stock is up above 1,000 percent in the last 12 months," he said. Just a year ago, Carvana faced considerable challenges, with questions about its survival.

"They were trying to issue bonds to raise capital and there were a lot of headwinds over there. But you have to give them credit. They really had an incredible turnaround," he added. That turn has been driven by a focus on improving margins rather than sheer volume, resulting in improvements.

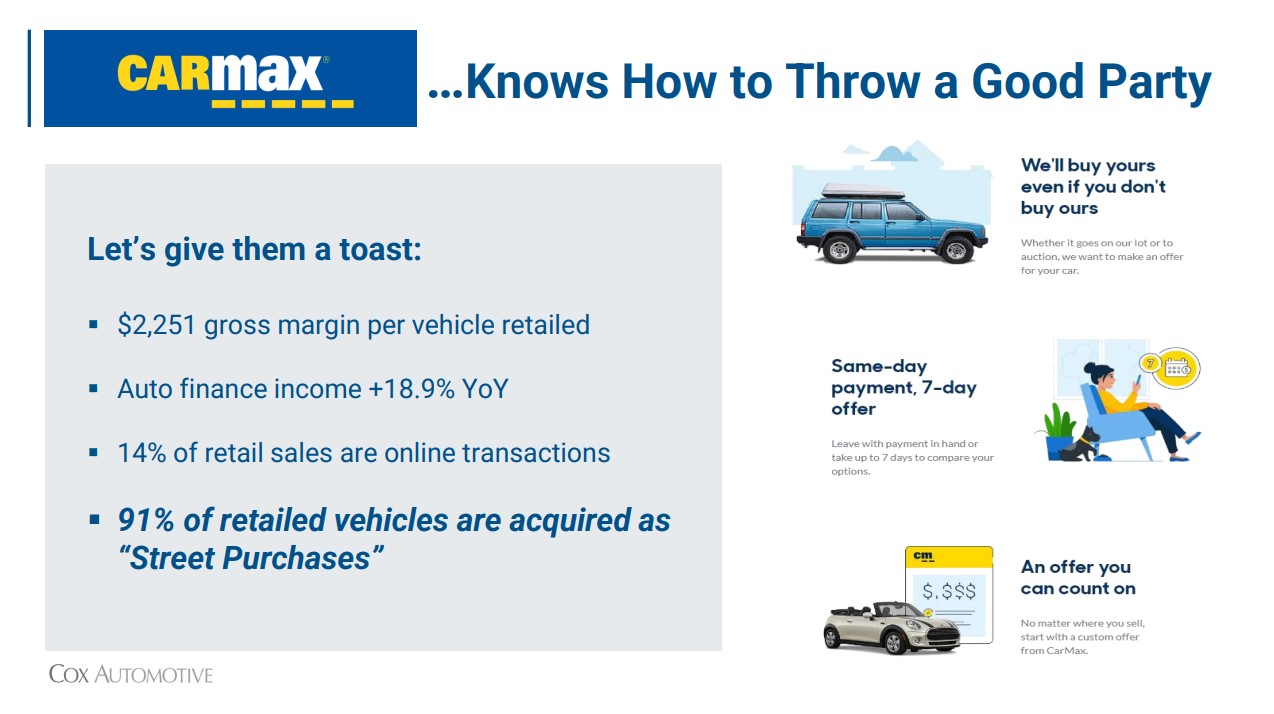

Not to be outdone, Richmond-based CarMax also made impressive strides, particularly in its online business — up almost 15% on the year, Finkelmeyer noted, adding that CarMax's innovative approach to sourcing inventory directly from consumers has contributed to its success.

"91% of CarMax vehicles are purchased off the street," which enables them to reduce costs and improve margins. Finkelmeyer underscored the importance of creating transparency and low friction in the appraisal process, citing a personal experience where competitive offers from CarMax and Carvana influenced a trade-in decision.

"We need to adopt a philosophy around trust and transparency instead of... trying ‘to steal trades from customers,’ " he advised attendees on the evolving landscape of inventory sourcing.

Party Crasher No. 1: Rising Inventories

Finkelmeyer also highlighted three “party crashers” to the continued success in retail automotive.

Finkelmeyer also highlighted three “party crashers” to the continued success in retail automotive.

First: rising inventories. Dealers and other experts alike know the automotive industry is grappling with an influx in new car inventory, a trend that has set off alarms for dealers nationwide.

Inventory surged by almost a million cars in just the first quarter of this year alone, marking a staggering 50% increase compared to the same time last year. This increase, while retail sales have only seen a modest 3% uptick, can spell trouble, as it creates a landscape ripe for escalating incentives.

"We're definitely seeing car companies get back in the game on the incentive front," he said, indicating a potentially costly path ahead for dealerships.

This influx is mirrored by a relatively flat trajectory in used car inventory over the last few years. However, the bulk of this change seems to be concentrated around specific brands, with Toyota and Honda maintaining a tight day-supply while other brands witness sizable growth in available inventory.

The influx places strain on dealerships, exacerbating challenges related to pricing, margin erosion, and consumer demand. To navigate this terrain, dealers must adopt proactive inventory management strategies, focusing on optimizing stock levels and aligning offerings with evolving consumer preferences.

"We obviously need to continue to focus on turning inventory but having a deeper understanding of that inherent value in each vehicle in your inventory," Finkelmeyer said. That approach will be pivotal in mitigating the adverse effects of burgeoning inventories and fostering sustainable growth within the automotive sector.

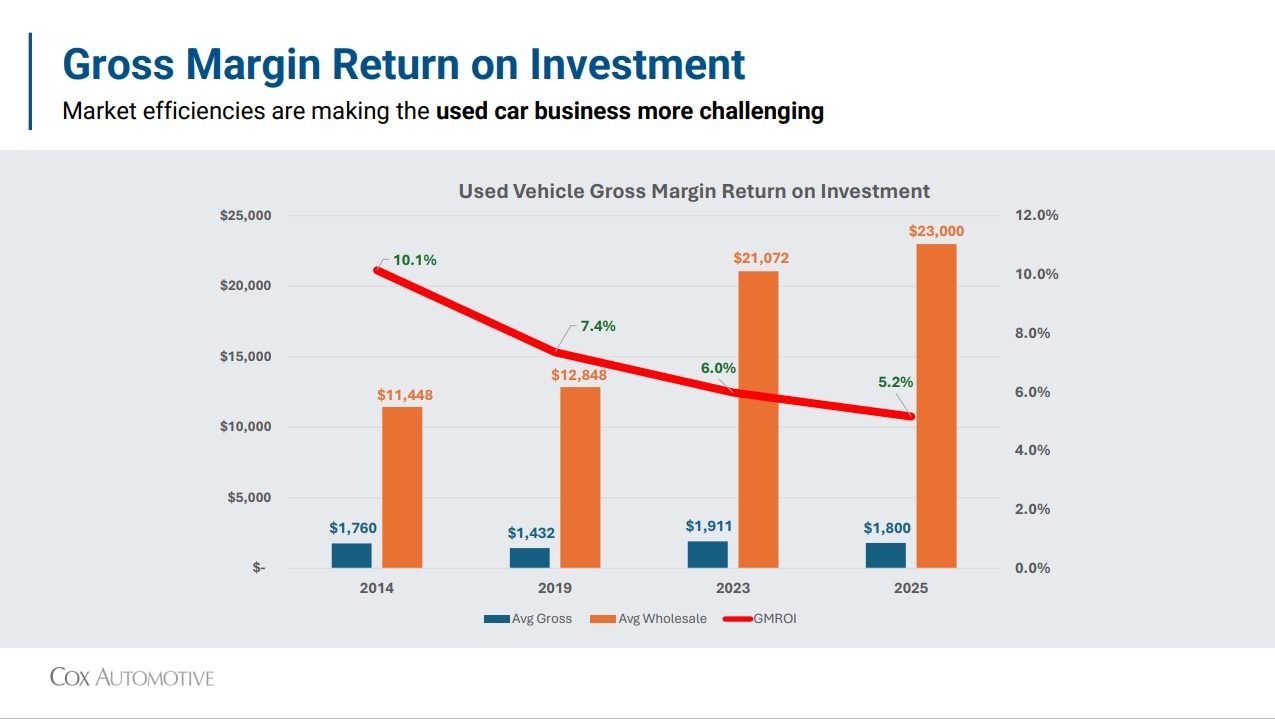

Party Crasher No 2.: Lower Margins

Despite the uptick in new car inventories, the industry is witnessing a corresponding decline in profitability. This profitability decline is evident in the shifting landscape of average invoice prices, which have increased from $37,000 to approximately $45,000 today.

Despite the uptick in new car inventories, the industry is witnessing a corresponding decline in profitability. This profitability decline is evident in the shifting landscape of average invoice prices, which have increased from $37,000 to approximately $45,000 today.

"Back in 2019, we basically had a million more vehicles available in dealer inventory, but they were less expensive vehicles,” he said.

Finkelmeyer said the substantial cost incurred by dealerships due to margin pressures leads to an additional $550 million per month in floor-plan costs. That reality underscores the urgency for dealerships to reassess operational strategies and adapt to the evolving market dynamics, he said.

By using data-driven insights and implementing targeted pricing adjustments, dealerships can minimize the impact of lower margins and maintain profitability amid market uncertainties, he said.

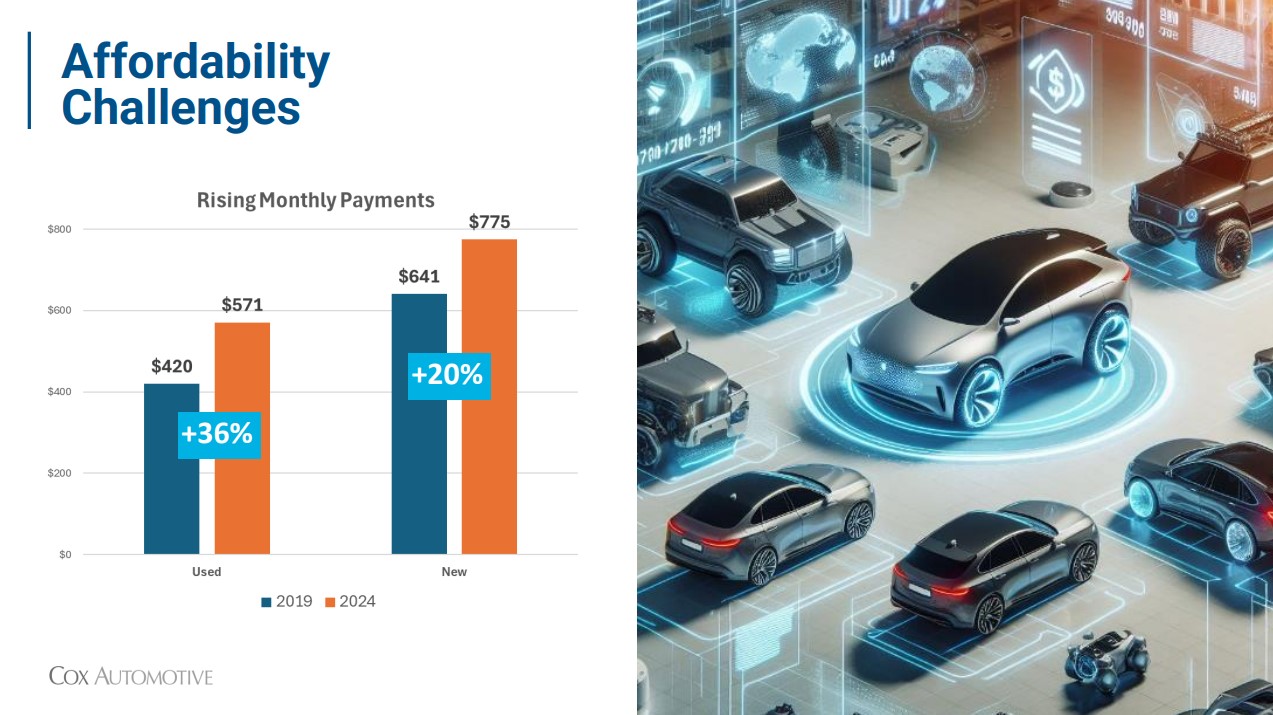

Party Crasher No. 3: Affordability Challenges

As new car inventories surge and margins face downward pressure, affordability casts a shadow over the market's future outlook.

As new car inventories surge and margins face downward pressure, affordability casts a shadow over the market's future outlook.

Finkelmeyer delved into the data revealing the stark reality facing consumers: an exponential increase in new car payments, with average monthly payments soaring 36% since 2019 to $775 — a substantial jump from previous years. "Now we have to keep a straight face when we're talking [to customers] about an $800 a month payment," he said.

This acknowledgment of changing consumer expectations explains the need for dealerships to prioritize affordability and accessibility in sales tactics, he said.

Finkelmeyer called out the discrepancy between consumer budgets and market conditions, citing industry benchmarks that recommend car payments not exceeding 10% of take-home pay. That guideline translates to affordability constraints for much of the population. “Only 50% of Americans can afford a $400 car payment," he said. The disparity showcases a widening gap between affordability thresholds and market realities.

What Happened to EVs?

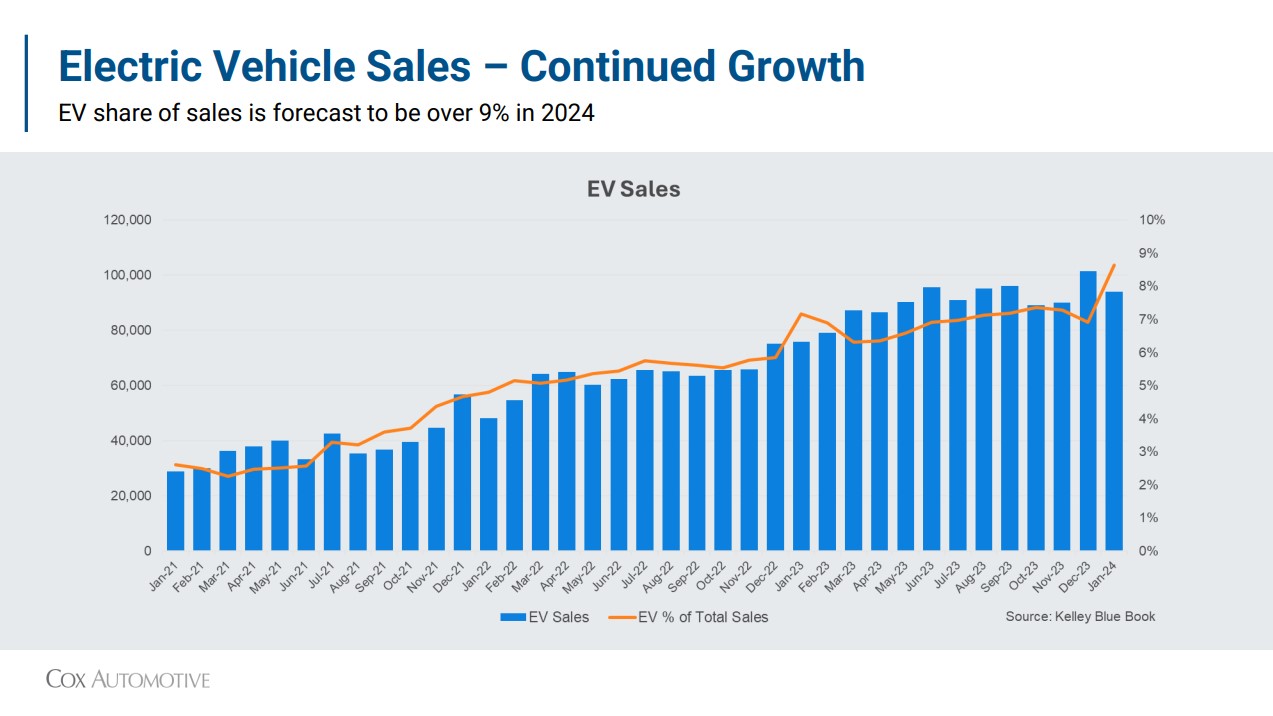

Finkelmeyer didn't shy away from addressing the elephant in the room: The state of the electric vehicle (EV) market.

The stark comparison between the soaring market cap of Tesla in 2021 and the current state of affairs served as illustration of what Finkelmeyer termed "irrational exuberance." He expressed incredulity at the trillion-dollar loss in market cap among EV manufacturers Tesla, Lucid and Rivian, signaling a sobering reality check for the industry.

Moreover, Finkelmeyer highlighted the cautionary tale of Hertz's foray into EVs, serving as an example of the pitfalls of overcommitting to the EV market without a solid strategy. He cited the rental company’s substantial losses and subsequent liquidation of excess EV inventory, with some vehicles fetching as low as $17,000.

Moreover, Finkelmeyer highlighted the cautionary tale of Hertz's foray into EVs, serving as an example of the pitfalls of overcommitting to the EV market without a solid strategy. He cited the rental company’s substantial losses and subsequent liquidation of excess EV inventory, with some vehicles fetching as low as $17,000.

Amid the setbacks and uncertainties, Finkelmeyer offered optimism, noting the steady climb in EV sales and Cox Automotive's forecast of EVs capturing 9% of total industry sales share.

He cautioned against viewing these sales gains as sustainable, though, since many manufacturers are throwing incentives at consumers. “This is not a sustainable business model for automakers,” noting many manufacturers are losing money on every EV sold. “At some point, the car companies have to come to terms with that.”

Finkelmeyer emphasized the importance of adapting to the evolving EV landscape while remaining cognizant of profitability considerations. He echoed General Motors CEO Mary Barra's sentiment that the truth about EVs likely lies somewhere between the extremes of hype and skepticism. Indeed, in Q1, hybrid vehicles led the pack across all powertrains, with a 40% gain year over year.

Despite headwinds, "we should also feel optimistic about the fact that the industry is still very healthy,” Finkelmeyer concluded. “Smart dealers are going to take action to mitigate these party crashers. We have to feel pretty good about the business we're in, and will likely finish this year on a very positive note.”