April 12, 2024

By Barrie Charapp Beaty

Charapp & Weiss, LLP

bbeaty@cwattorneys.com

Dealers constantly face the challenge of managing and training employees to work steadily and uniformly to reach the dealership’s goals. Employees may resist mandated training, but ignoring the need for such consistent efforts, especially on compliance, can be costly.

In February 2024, a class action suit was filed against Toyota, Toyota Motor Credit Corporation and unnamed dealer defendants in the United States District Court for the Central District of California.

The suit alleges that the ToyotaCare Plus maintenance plan, which costs more than $1,000, was falsely marketed as a lower cost alternative to paying each scheduled maintenance individually at the time of service.

The suit's allegations are that the Toyota representatives:

- [lied] to consumers about the value of the Maintenance Plan and including [the plans] on contracts without consumers’ knowledge, and/or rushing through paperwork to hide buried terms;

- deceived consumers who inquired about the value of the services they were receiving and why certain services were scheduled ahead of time;

- included services in the prepaid Maintenance Plan that were already covered by a vehicle’s warranty; and,

- [failed to] provide consumers with all of the prepaid services they purchased under the Maintenance Plan.” Among California specific claims, the claims include unjust enrichment, fraud, negligent misrepresentation, violation of Magnuson-Moss Act, violation of the Lanham Act for false advertising, and breach of contract. Notably, Magnuson-Moss claims are not subject to pre-dispute arbitration agreements.

This case is fair warning to vendors, captives, manufacturers and dealers that not only is the FTC coming after the voluntarily protection products but so are the plaintiffs’ counsel.

This case is fair warning to vendors, captives, manufacturers and dealers that not only is the FTC coming after the voluntarily protection products but so are the plaintiffs’ counsel.

Training your personnel is key to keeping you F&I compliant.

- No False Representations. If you are selling a product such as a maintenance plan, make sure the representations are accurate. Do not represent to the consumer that they will be paying less per service if they purchase the maintenance plan at the time of sale instead of paying for the maintenances individually.

- Train Personnel on the Products they are Offering. Sales and F&I personnel should know the products they are selling. They should not just be following a script. They should take the time to educate themselves on the products and the terms for the programs. Not knowing the products often leads to the misrepresentations. The products being offered should offer value to the consumer. If the consumer is paying cash, the personnel should not be selling a GAP warranty.

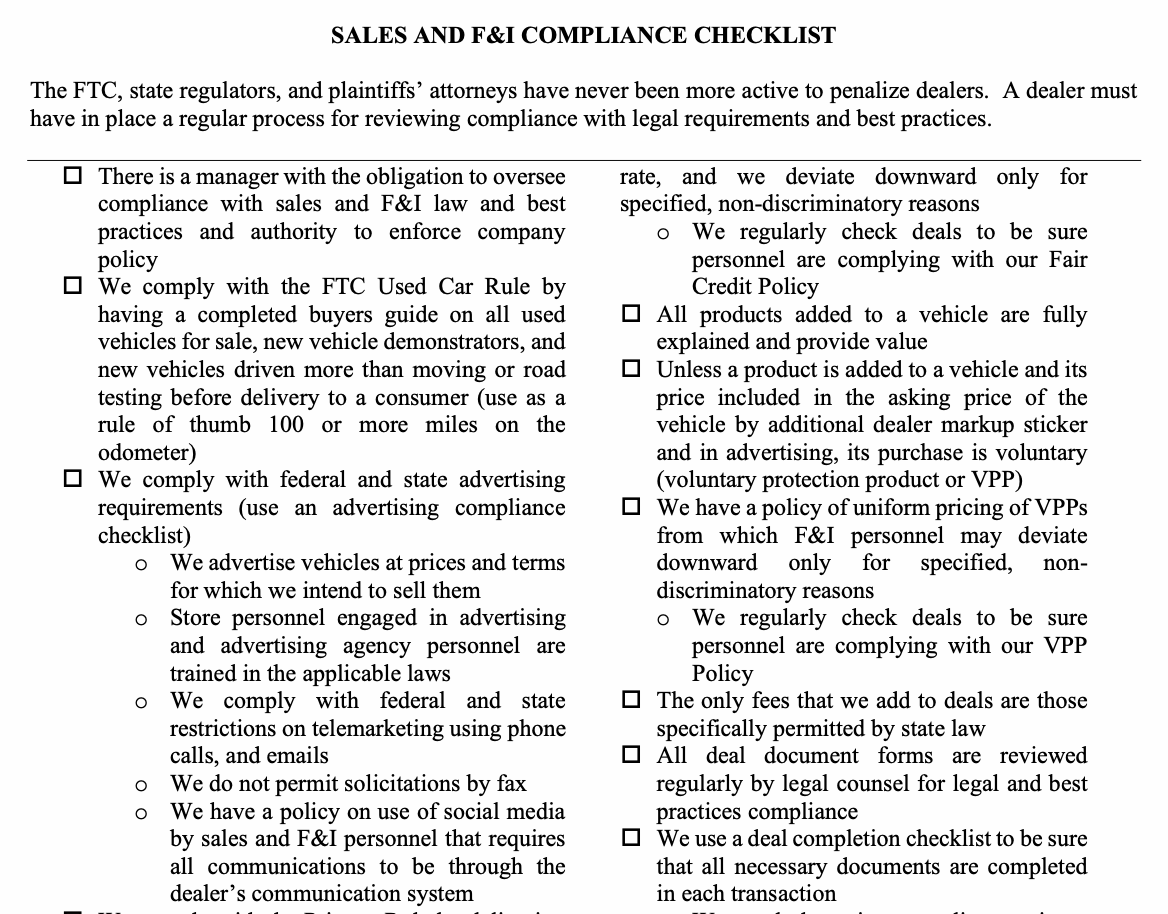

- F&I Compliance Program. An F&I compliance program that constantly trains employees must be adhered to. Use the NADA policy on voluntary protection products to establish uniformity in offering prices on the voluntary protection products to all consumers. Use the NADA’s policy for fair lending so that establish uniformity in credit rates offered to customers. Sample document available here.

- Use a Menu. Make sure you have menus with the VPPs and the pricing. Make sure the disclosures of the products and pricing are on the menu. For best practices, the buyer should sign a copy of the menu indicating the chosen and declined products should be kept in the deal file. And importantly, make sure the prices on your menu match the prices on the Buyer’s Order.

- Cash Reporting. Your personnel knows that cash over $10,000 needs to be reported, but often lack of training gives way for the nuances to the rule to slip by. If you are paid in thousands of dollars of cash and have to return the amount paid, the returned monies should be in the same tender as provided (i.e., cash for cash, check for check). If you are returning thousands of dollars in cash, write down the bill numbers, take pictures of the monies returned, and provide the person with a receipt. If you know the money tendered is not from legal earnings (i.e., the person paying in cash is your brother-in-law’s dealer), don’t do the deal and don’t take the money. If you have 3 transactions in a row where the same person paid with a check for $8,000, then $5,000, and then $8,000, it is a reportable transaction. Train your personnel on the nuances of cash reporting.

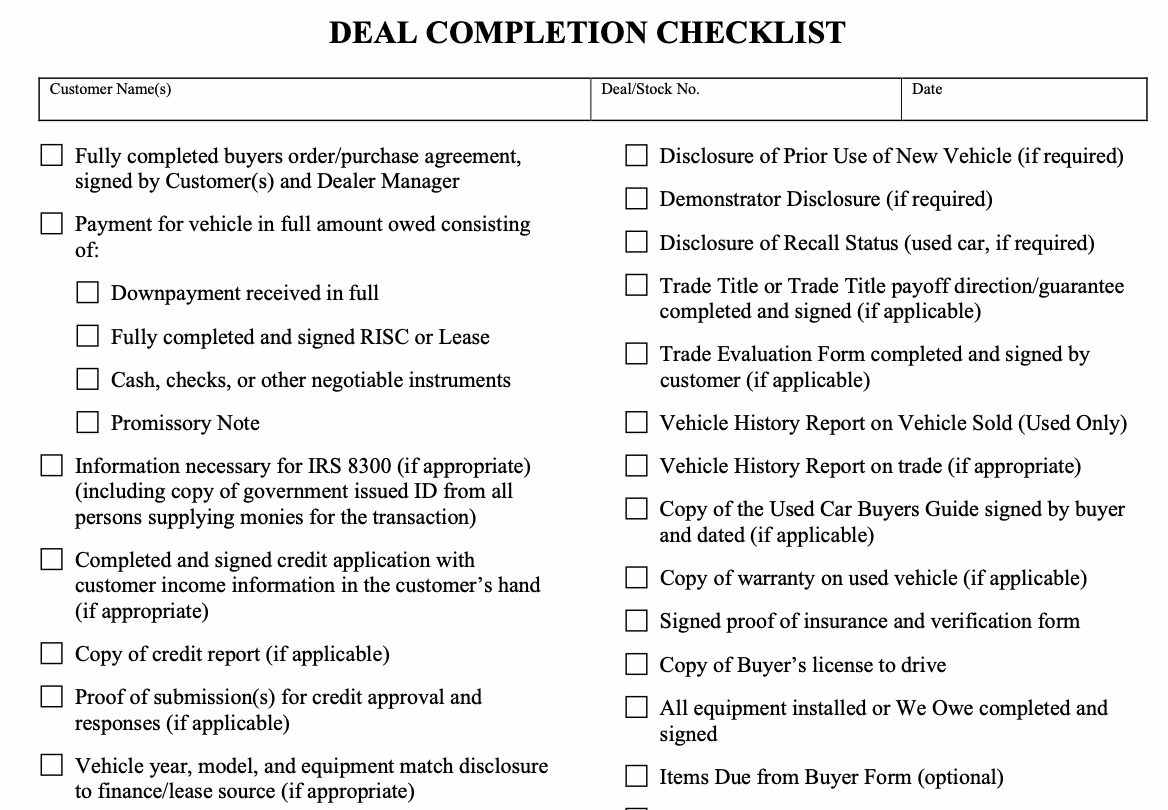

- Use a Deal Checklist for the Deal File Documents. The F&I department needs to ensure that all documents required in the deal file are actually in the deal file. Often the F&I personnel and the comptroller are at odds because F&I wants the deal booked so that they are paid on the deal, but the comptroller can’t book the deal if documents are missing. Train the F&I personnel on the documents that are needed. Use a deal checklist so that they have everything needed in the deal file — we've got one for you here.

In summary, compliance training needs to routinely occur. Your personnel need to know the compliance program and need to constantly be trained to avoid costly lawsuits (and government investigations).