A little annual attention to your dealership's forms and processes could go a long way in terms of helping avoid costly litigation.

November 8, 2023

By Barrie Charapp Beaty

Mahdavi, Bacon, Halfhill & Young, PLLC

Dealers’ forms give the best protection against expensive claims and lawsuits. Unfortunately, too often dealers pay little attention to their sales forms, including the need to update those forms. Every dealership needs a program for regulating deal paperwork packages. Here are the essential elements of any program:

- Your dealership should have a standard deal package. We name and explain a few key forms that should be in every dealer’s package, but it’s not inclusive of all of the forms that should be in the package. You should have the dealership’s legal advisor review your standard deal package to determine if you are missing key forms.

-

Buyer’s Order

The Buyer’s Order is required by the law. The Buyer’s Order is one of the most important documents between you and the customer. It is the contract that spells out the transaction between you and the customer. Virginia law provides what may or may not be allowed in the Buyer’s order such as fees that are allowed to be charged. Virginia law also provides that the conditional delivery language should be in the Buyer’s Order, thereby replacing any separate spot delivery document. A separate spot delivery document should not be used. The Buyer’s Order may have an arbitration provision that could prove very valuable to future interactions with the customer. For ease, the arbitration provision should match the RISC, if there is one in the transaction.

-

Payment Documents

Whether the payment is with promissory note, hold check form, hold contract form, retail installment sale contract (RISC) form, or lease form, it should be in the file. Similar to the Buyer’s Order, the RISC should be in the customer’s file and completed properly according to the transaction. The amounts on the Buyer’s Order should match the amounts on the RISC.

-

Privacy Notice

The dealer paperwork should include a Privacy Notice given to the customer when an authorization to run a credit report is signed.

-

Credit Application

We recommend that every customer seeking dealer arranged financing should have a handwritten credit application signed by them in the file for best practices. We have seen numerous cases against dealers where customers claim that they did not authorize the dealer to run their credit, or it’s not their signature on the credit report. A best practice, and best protection for the dealership against claims that it improperly ran a customer’s credit, is a handwritten and wet-signature executed credit application by the customer.

-

Damage Disclosure

Barrie Charapp Beaty of VADA legal partner Mahdavi, Bacon, Halfhill & Young, PLLC

The dealership should have a Damage Disclosure form available to be filled out in the event the dealership has to disclose known prior damage on new and used vehicles.

-

Prior Use Disclosure

The Prior Use Disclosure is a form that discloses to the customer the mileage accumulated on a new car from a prior spot delivery not completed. Some states, like Maryland, require that the prior use for any and all used vehicles such as whether the vehicle was a rental on either the buyers order or in a separate form.

-

Demonstrator Disclosure

If the vehicle has previously been a demonstrator, a disclosure should be used. Some states require the disclosure notice to be on the Buyer’s Order (i.e., Virginia).

-

Buyers Guide

We have written numerous articles on the Buyers Guide. If you are selling a used vehicle, you are required by federal law to have a Buyers Guide on the vehicle. Federal Trade Commission’s (FTC) Used Car Rule requires that the customer receive the Buyers Guide with the sale of the vehicle. For best practices, (and required by some states like Virginia), the Buyers Guide should be signed and dated by the customer to acknowledge receipt, with language that states “I hereby acknowledge receipt of the Buyers Guide at the closing of this sale." The customer shall receive either the original or a copy of the Buyers Guide (signed and dated) and the other shall be kept in the customer’s deal paperwork. Make sure the dealership file has a signed and dated version for best practices. The Buyers Guide needs to be filled out correctly. If there is no dealer warranty, the section “AS IS - NO DEALER WARRANTY” shall be marked. If the dealership is warranting the used vehicle, the Buyers Guide does not serve as the warranty document. A separate warranty document on the warranty the dealership provides should be provided to the customer.

-

We Owe Slip

A We Owe document should be given when something is owed to the customer or, more importantly, to have a customer sign when nothing is owed to the customer. It is important to have on your We Owe document that the dealership shall not be responsible for any items not collected by the customer after ninety days.

-

Items Due from Customer Form

For best practices, you should have an items due form that is signed by the customer to acknowledge what the customer owes the dealership to complete the deal. If the customer owes you a title, money, or even a verification document to receive an incentive, the form should be filled out and executed so there is proof that the customer had to bring that back to the dealership. This form better protects the dealership.

-

Proof of Insurance and Verification

Many states require proof of insurance or pay the uninsured motorist fee.

-

Trade Title Guarantee and Payoff Authorization

There should be a title guarantee document and payoff authorization so that you can obtain title to a trade-in. In the Buyer’s Order, there should be language on the back that states the failure to deliver unencumbered title would be a default and dealer may cancel the transaction. However, a title guarantee document and payoff authorization would further your rights to gain a trade title.

-

Consent to Use Testimonial or Image

Your dealership should have a form that customers fill out authorizing the dealership to use their image or testimonial. In the today’s world of social media, your personnel may post a picture of the happy customer in her/his new vehicle. Without the customer’s consent, the customer may not be so happy that her/his image is on the dealership’s social media account. Protect the dealership from claims of improper use of a customer’s image, which could classify as an advertisement by the FTC.

- Make sure all the documents in the deal file to be executed by the customer, are actually executed by the customer. Dealership personnel should not be signing any forms on behalf of the customer, except for a limited power of attorney for title documents (and the limited power of attorney should be completed appropriately in the deal file). If a document was not executed by the customer and needs to be to complete the deal, bring the customer back in and get the form executed.

- Regularly review the forms with the dealership’s legal advisor to ensure that they comply with the law and provide the latest protections for the dealership. Do the forms contain any prohibited terms? Has the dealership included up-to-date provisions to protect the dealership from claims and lawsuits? Are you using out-of-date forms or not permitted forms in your state?

- Train employees in use of the forms. Employees must understand the forms and how to use them. Not all forms should be used in all deals. It can be as serious to give a demonstrator disclosure when a vehicle is not a demonstrator as it is to fail to give that disclosure when it should be used. Most importantly, the dealership should train employees that they may use only the dealership forms. They are not to use forms that they’ve picked up along the way while working at other dealerships. All too often we hear from the dealership that the manager that came from another state used the form in that state and it was great. A form in one state may not be permissible in another.

- Be sure all forms are well printed, clean, and crisp. Too often, forms are simply copied over and over again. They become difficult to read and skewed at an odd angle. Either have forms printed or have them copied each time from a master or a freshly printed computerized version.

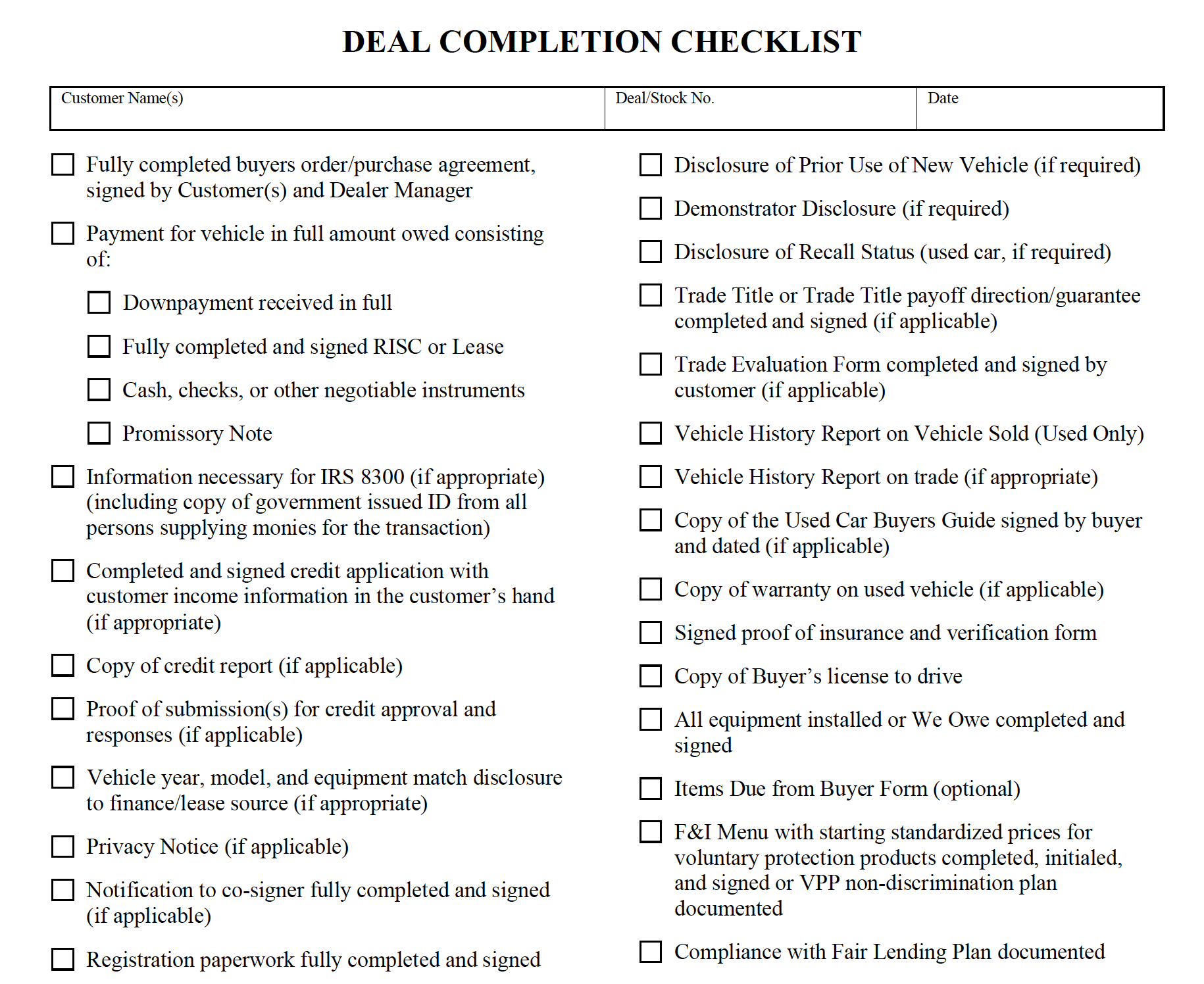

- Have a deal completion checklist and have someone check completed deals. At some point in the deal process, an employee should check each deal to ensure that all the forms required by the deal completion checklist are complete and in the deal. The deal completion checklist should identify the forms that must be completed and should list forms for certain vehicles that have special characteristics (prior damage, prior use, etc.). Your dealership should have a checklist to ensure the deal package in the customer’s file is complete. We offer a sample deal completion checklist on page __ of this Newsletter. From time to time, completed deals should be spot checked to ensure that dealership personnel are properly finalizing deals.