- Cox Automotive forecast: U.S. auto sales in May to finish near 1.54 million units, well ahead of 2020 sales volume, down 3% from 2019.

- Sales pace forecast to fall to 16.5 million, down from last month's robust 18.5 million pace.

- Inventory issues: Days' supply now down 71% from last year, 65% below 2019 levels.

ATLANTA – According to a forecast released this week by Cox Automotive, automobile sales in the U.S. are expected to be healthy in May, but down from April’s historic result. Sales are expected to finish at a seasonally adjusted annual rate (SAAR) of 16.5 million, with sales volume at 1.54 million. This is an improvement over last May’s COVID impacted 12.1 million SAAR and volume of 1.12 million. Compared to 2019—a better measure to judge the market’s recovery—sales are expected to drop by approximately 3%. The May 2019 SAAR was 17.3 million, with volume of 1.58 million.

ATLANTA – According to a forecast released this week by Cox Automotive, automobile sales in the U.S. are expected to be healthy in May, but down from April’s historic result. Sales are expected to finish at a seasonally adjusted annual rate (SAAR) of 16.5 million, with sales volume at 1.54 million. This is an improvement over last May’s COVID impacted 12.1 million SAAR and volume of 1.12 million. Compared to 2019—a better measure to judge the market’s recovery—sales are expected to drop by approximately 3%. The May 2019 SAAR was 17.3 million, with volume of 1.58 million.

The first four months of 2021 have delivered a surprisingly strong light-vehicle market, with a sales pace close to 17.3 million through April. May is likely to show a slowing market. “Supply is more than 40% below last year’s levels, and many dealers have little inventory available,” said Charlie Chesbrough, senior economist, Cox Automotive. “Memorial Day weekend is historically one of the biggest selling periods of the year. What’s historic now is the exceptionally low inventory.”

Cox Automotive is expecting the tight inventory situation to remain throughout the summer and possibly for the rest of 2021. Production shutdowns during the initial COVID crisis last year, and various supply chain disruptions including the global computer chip shortage, have left the industry with too few vehicles. According to an analysis of vAuto Available Inventory data, there are nearly 1.4 million fewer new vehicles in inventory at dealerships this May versus last May—a 42% reduction.

The supply shortage means buyers will likely pay more, as well, if they find a suitable vehicle. Transaction prices are high due in large part to a more expensive product mix of tech-heavy crossovers and SUVs. Sales incentives are also low, and dropping, in 2021. In April, the average incentive as a percent of average transaction price (ATP) was 7.9%, according to an estimate by Cox Automotive’s Kelley Blue Book. In 2019, the average incentive was 11.1% of ATP and incentives averaged 11.3% of ATP in 2020.

Given the low supply and strong demand in the market today, buyers will find fewer “good deals” this Memorial Day weekend. Fortunately, according to recent research by Kelley Blue Book, the majority of shoppers are not expecting traditional deals this holiday weekend. In fact, many are anticipating, and willing, to pay over sticker price for a new vehicle.

May 2021 Sales Forecast Highlights

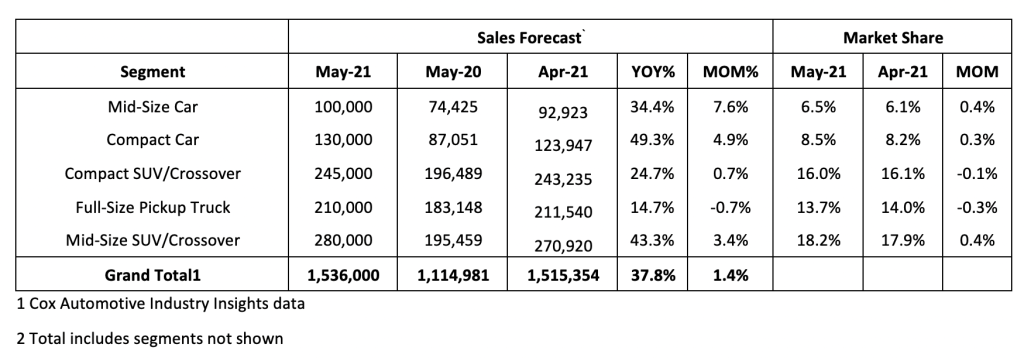

- New light-vehicle sales volume is forecast to rise over 421,000 units, or nearly 38%, compared to May 2020. When compared to last month, sales are expected to rise nearly 21,000, or 1.4%.

- The SAAR is estimated to be 16.5 million, well above last year’s COVID impacted 12.1 million level, but a decrease from April’s strong 18.5 million pace.

- Available new-vehicle supply in mid-May was 1.95 million, down from 2.24 at the end of April. Supply is now 42% below last year, or 1.4 million units.

All percentages are based on raw volume, not daily selling rate. There are 26 selling days in May. There were an equal number in May 2020 and 2019.

About Cox Automotive

Cox Automotive Inc. makes buying, selling, owning and using vehicles easier for everyone. The global company’s more than 27,000 team members and family of brands, including Autotrader®, Dealer.com®, Dealertrack®, Dickinson Fleet Services, Kelley Blue Book®, Manheim®, NextGear Capital®, VinSolutions®, vAuto® and Xtime®, are passionate about helping millions of car shoppers, 40,000 auto dealer clients across five continents and many others throughout the automotive industry thrive for generations to come. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately-owned, Atlanta-based company with annual revenues of nearly $20 billion. www.coxautoinc.com