By Dixon Hughes Goodman LLP

State Conformity - Federal Paycheck Protection Program (“PPP”) Loan Forgiveness and Expenses Deduction

The Consolidated Appropriations Act of 2021 (“CAA”) was signed into law on December 27, 2020. Included in the CAA were provisions that provided for the full deductibility of all covered period expenses and for no tax attribute to be reduced nor any basis increase denied by reason of the loan forgiveness being excluded from gross income. This was a big win for dealers and their dealerships that obtained a PPP loan as prior to the enactment of the CAA the IRS had issued guidance that called for a dollar for dollar disallowance of covered period expenses based upon the anticipated or known amount of loan forgiveness that would be excluded from gross income as provided for by the Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”). As a result of the CAA, states were forced to decide how to address the change in federal treatment of covered period expenses and dealers were left wondering in many cases as to what the outcome might be.

State Conformity to Federal Changes

States incorporate provisions of the Internal Revenue Code (“IRC”) into their own revenue codes based on one of the three approaches – rolling conformity, static conformity, or selective conformity. Rolling conformity states adopt changes to the IRC automatically unless the state legislature passes specific legislation to decouple from a provision. Static conformity states conform to the IRC as enacted on a specific date and the state legislature must enact legislation to advance the date of conformity and conform to any changes made to the IRC. Selective conformity states conform to some IRC provisions and decouple from others.

Virginia Treatment of Payroll Protection Program Funds

Virginia is a fixed date conformity state meaning that the Virginia General Assembly needed to enact legislation to update the state’s conformity date to the IRC before dealers would know for sure how Virginia would treat the PPP. On March 15, 2021, Virginia Governor Ralph Northam signed S.B. 1146 to advance the state’s date of conformity to the IRC from December 31, 2019, to December 31, 2020. Virginia now conforms to the CARES Act and the CAA[1].

Virginia Paycheck Protection Program Loan Forgiveness and Expenses Deduction:

Virginia now conforms to the federal tax exemption from income of the PPP for tax year 2020.[2] However, Virginia decouples from the federal provisions allowing dealers to claim a full deduction for business expenses paid for with the forgiven PPP funds. Instead, for tax year 2020, Virginia caps the deduction of expenses allowed at $100,000 for individuals and corporations. Furthermore, for dealerships taxed as pass-through entities, the $100,000 cap applies at the entity level.[3]

For taxpayers that have received PPP loan forgiveness of $100,000 or less for taxable year 2020, no adjustment is required on the taxpayer’s 2020 Virginia return.[4] On the contrary, taxpayers who have received PPP loan forgiveness of more than $100,000 for taxable year 2020 must report an addition to their state income equal to:

- a) The amount of business expense deduction disallowed under the principles in the Internal Revenue Service (“IRS”) Notice 2020-32 and subsequent pre-CAA IRS guidance;

- b) Less $100,000.[5]

Where the limitation has been applied at the pass-through entity level, there is no need to re-apply it at the dealer / owner level.[6]

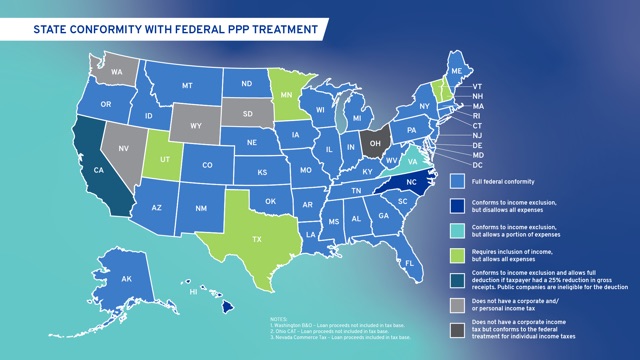

Summary Comparison of PPP Loan Treatment by Select States:

The vast majority of states have fully conformed to the federal income tax treatment of the PPP loans for corporate income tax purposes – the forgiven loan is not considered income and the expenses paid for by the forgiven loan are deductible. How each state has conformed to these changes is different based on how the individual state conforms to the IRC. As an example of rolling conformity states, Alabama has issued specific guidance providing that the exclusion to PPP loan forgiveness under Section 1106 and the deduction of expenses will flow through to the taxpayer’s calculation of Alabama taxable income, without the need for any adjustment on the taxpayer’s Alabama return.[7] This was true even though Alabama automatically conformed to the IRC changes made under the CARES Act and CAA. Maryland is a rolling conformity state, but does have the additional nuance of not automatically conforming to an IRC change if the state Comptroller determines that a federal change will impact Maryland tax revenues by $5 million or more and declares that the state will decouple from federal provisions. With regard to the CAA, the Comptroller determined that no provision met the automatic decoupling threshold which meant that Maryland fully conforms to the federal treatment of PPP loans.[8]

In contrast, Georgia is a static conformity state; as such, the Georgia General Assembly must enact legislation to update the IRC date of conformity in the Georgia revenue statutes if it elects to conform to any federal changes. On February 24, 2021, House Bill 265 was signed into law. With the passage of H.B. 265, Georgia adopted PPP loan forgiveness and the deductibility of the related PPP deductions for all years.[9] North Carolina,another static conformity state, updated its revenue laws to conform to the exclusion from income of forgiven PPP loans but, as of the writing of this article, has not updated its laws to conform to the allowance of a deduction for expenses paid for with the forgiven PPP loans. North Carolina has pending legislation (House Bill 334[10]) which would allow full deductibility if ultimately signed into law. While California law allows for the income exclusion, it also recently passed and signed into law Assembly Bill No. 80 which allows businesses to deduct expenses paid for by forgiven PPP loans provided the business can show a 25 percent reduction in gross receipts in 2020. Public companies are not eligible for this deduction.[11]

See the attached map for a breakout of how states have treated PPP loans and the related expenses as of April 30, 2021.

DHG Observations

There are still some states, especially those that conform to the IRC on a rolling basis that have not yet come up with specific guidance regarding the treatment of PPP loans. DHG continues to monitor all state developments for any specific changes and/or guidance. As part of this analysis, we would recommend contacting your DHG Dealership Tax Advisor for further analysis or reach out to us directly at tax@dhg.com.

NOTE – All information in this article and the attached map is based on research of state laws and regulations as of April 30, 2021. It is very likely that certain states have changed their positions between the writing of this article and its published date.

[1] https://www.tax.virginia.gov/sites/default/files/inline-files/tb-21-4-irc-conformity-advanced.pdf.

[2] Ibid.

[3] Ibid.

[4] Ibid.

[5] Ibid.

[6] Ibid.

[7] https://revenue.alabama.gov/wp-content/uploads/2020/12/201218_ProclamationGuidance.pdf.

[8] https://marylandtaxes.gov/forms/Tax_Publications/Tax_Alerts/CAA-Decoupling-Tax-Alert-040721.pdf.

[9] https://dor.georgia.gov/rules-policies/income-tax/income-tax-federal-tax-changes.

[10] https://www.ncleg.gov/Sessions/2021/Bills/House/PDF/H334v2.pdf.

[11] https://leginfo.legislature.ca.gov/faces/billNavClient.xhtml?bill_id=202120220AB80.