For the first time in many years, Virginia has completed a comprehensive overhaul of the Buyer's Order form. The move is designed to provide greater protections for dealers, improve clarity for consumers, and address modern compliance standards. The new forms – including an optional Lease Buyer's Order – will be issued starting May 1, with no hard deadline for implementation.

VADA General Counsel and Executive Vice President Anne Gambardella and our outside counsel Barrie Beaty have recorded a short presentation below to walk dealers through the new forms.

Key Updates to the Buyer's Order:

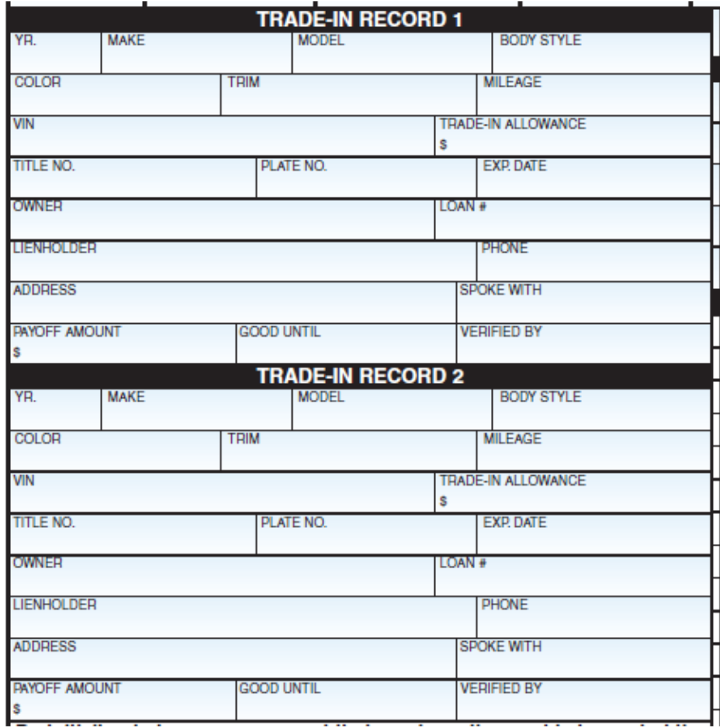

- Clearer Structure: Organized sections group like items (e.g., taxes, fees, contracts) with additional space for writing line items – for example, two trade-in vehicles)

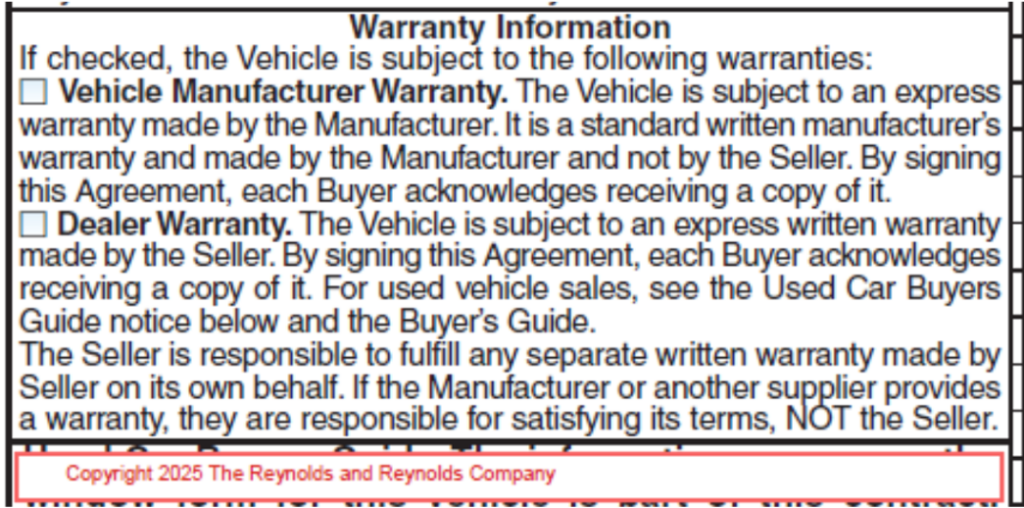

- Warranty Disclosure: Prominently displayed on the front page for both new and used vehicles. Must be consistent with Buyer's Guide – a critical compliance point.

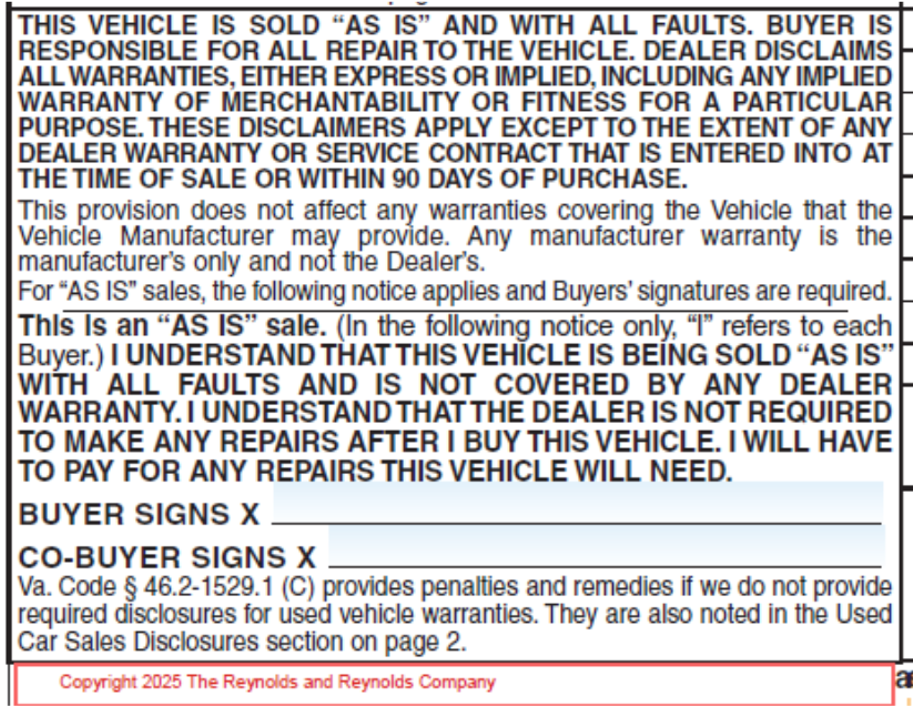

- "As-Is" language: A clearly visible box consolidates disclosures from both the front and back of the previous form.

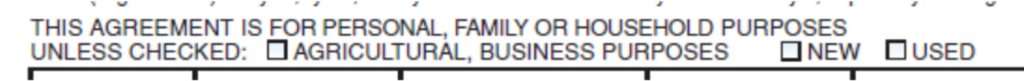

- New Checkbox for Vehicle Use: The forms defaults to personal use; you must check a box for business/agricultural use.

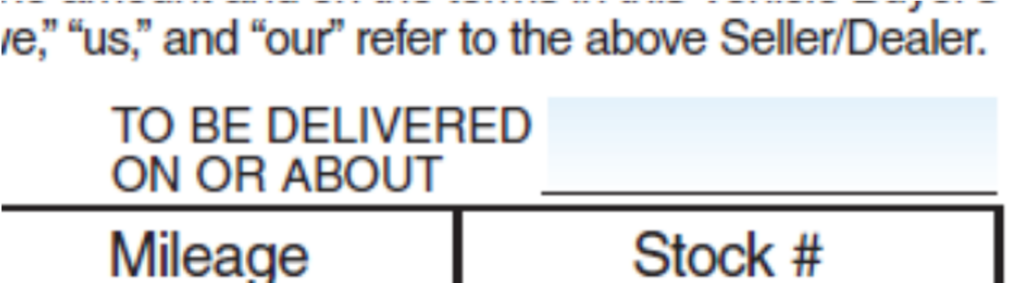

- Estimated Delivery Date: A new field allows dealers to specify an estimated delivery date for vehicles, improving clarity in delayed or conditional delivery situations.

- Spot Delivery and Arbitration: Spot delivery language is now codified and unified; supplemental delivery forms are no longer needed or recommended. The arbitration agreement is clearly stated, near the signature block, and matches standard provider requirements (see more below).

- No back page numbering: Unlike the existing form, the back of the new form does not use numbered paragraphs.

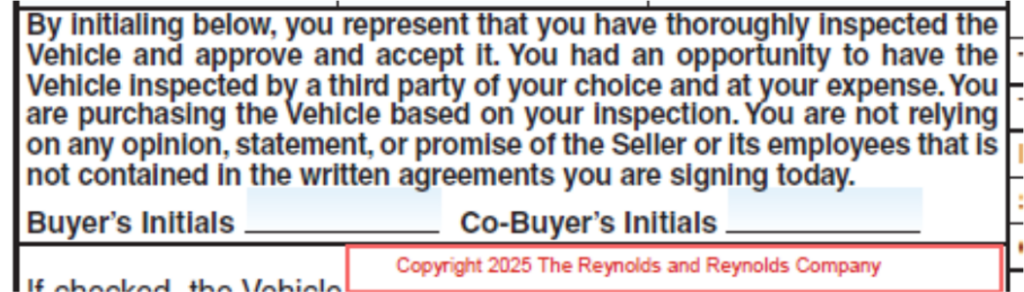

- Inspection and consent: The buyer confirms vehicle inspection or opportunity for third-party review. It also includes built-in consent for dealer communications (calls, texts, auto-dialing).

- Electronic Forms: Requires buyer initials on each page to confirm review and agreement. Most DMS systems will prompt for this automatically.

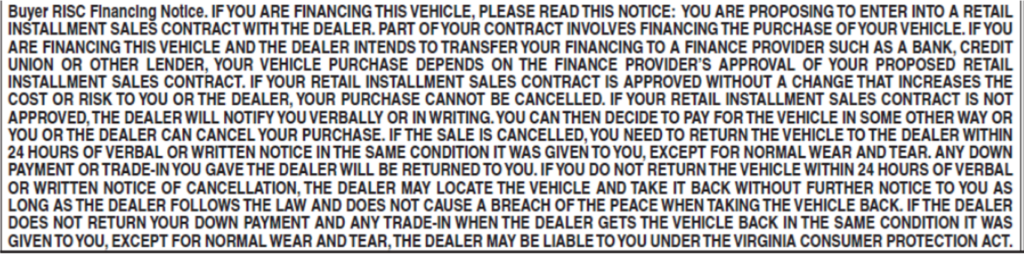

- Consumer financing clause: A new provision allows cancellation of deals if third-party financing isn't secured within two days.

For more information, contact our Partners

at Reynolds & Reynolds:

Cody Broadbent

Document Compliance

(315) 870-6258

Cody_Broadbent@reyrey.com

Jason Gaskill

Document Compliance

(910) 632 - 4680

Jason_Gaskill@reyrey.com

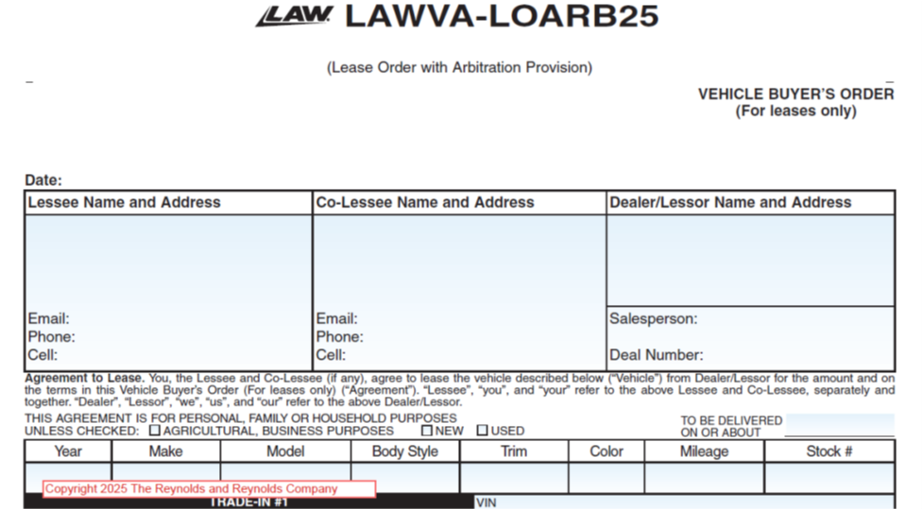

Lease Buyer's Order Overview

For the first time, Virginia law now allows dealers to use a Lease Buyer's Order form to better align with lease contracts. The order includes lease-specific terms, reducing confusion for consumers and improving consistency across documents.

This Lease Buyer's Order is optional, not required, and it is permitted starting July 1, 2025. VADA encourages dealers to begin transitioning when it makes sense for their business.

Key Features & Differences:

- No "As-Is" Language: The "as-is" statute does not apply to leases, but the order includes language that disclaims warranties as allowed under lease law.

- Spot Delivery Language: Newly created statutory language (passed with VADA's support in 2025) allows for conditional delivery in lease transactions, just like in retail sales. It's lease-specific, replacing "purchase" or "sale" with "lease" terms.

- Lease-specific Terms: The itemization on the form uses lease terms (e.g., gross capitalized cost, capitalized cost reduction, amount due at lease signing) that align directly with what appears on a lease agreement.

There's no fixed deadline to begin using the Lease Buyer's Order. Dealers should expect some reprogramming and staff training, particularly if using DMS systems that automatically implement the new forms. VADA Partners at Reynolds & Reynolds will begin issuing the new forms in May 2025 and will eventually phase out the older forms.

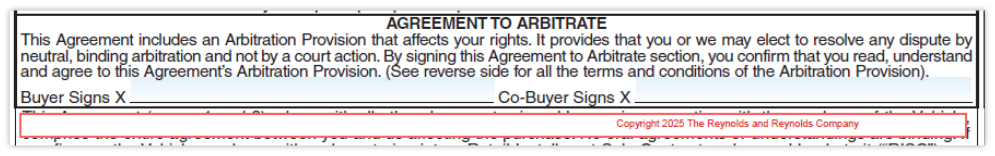

Arbitration Provisions

The language reduces liability risks by resolving through arbitration rather than litigation in most consumer actions and prevents class action arbitrations.

Clear Placement: On the printed version, the arbitration agreement appears on the front page, directly above the buyer's signature line for full execution of the buyer's order but also requires a separate buyer's signature. On the electronic version, it's on the second page directly above the buyer's signature line for full execution of the buyer's order but also requires a separate buyer's signature.

Consistency with Retail Installment Sale Contract (RISC): The language matches the arbitration provision in the Reynolds & Reynolds Retail Installment Sales Contract (RISC), which is widely used by dealers and required by many lenders. This consistency avoids conflicts between documents.

Use of AAA (American Arbitration Association): The form designates AAA as the default arbitration forum but allows for alternatives if both dealer and customer agree. AAA requires preregistration of the arbitration agreement in buyer's order prior to using its forum to adjudicate disputes.

Dealer Implementation Checklist

Dealers are strongly encouraged to retrain staff and reprogram DMS systems accordingly, and to consult legal counsel for implementation. For the new Lease Buyer's Order, your forms provider may make it mandatory within DMS systems once you select "lease" as the deal type (even though it's not legally required).

- Review and understand the new Buyer's and Lease Order forms

- Train all relevant staff on updated fields and compliance requirements

- Coordinate with DMS providers for form updates and electronic prompts

- Eliminate outdated supplemental forms (e.g., delivery agreements)

- Consult legal counsel on your dealership's specific implementation timeline.

Questions? Contact VADA:

Anne Gambardella

General Counsel & Executive Vice President

(804) 545-3006

agambardella@vada.com

Barrett "Barrie" Charapp Beaty

VADA Outside Counsel

(571) 346-7507

bbeaty@cwattorneys.com