April 14, 2025

By Barrie Charapp Beaty

Charapp & Weiss, LLP

bbeaty@cwattorneys.com

As car dealerships continue to navigate the complexities of workforce management, ensuring that all employees are properly documented for immigration purposes in today’s environment is paramount, especially under the Trump administration. Non-compliance can lead to severe penalties, including fines and legal repercussions. This article outlines proactive steps dealerships can take to ensure compliance with immigration laws and maintain a workforce that is both legal and efficient. It’s time to dust off your I-9 compliance procedures.

Consequences

Dealerships that fail to comply with I-9 documentation and verification requirements can face significant penalties. The potential consequences include:

- Civil Fines

- Failure to Complete I-9: Employers can be fined for failing to complete the I-9 form for each employee. Fines range from $250 to $2,500 per violation, depending on the size of the business and the nature of the violation.

- Failure to Maintain I-9s: Not retaining a completed I-9 for the required period can also lead to fines.

- Criminal Penalties:

- Knowingly Hiring Unauthorized Workers: Employers who knowingly hire or continue to employ workers who are not authorized to work in the U.S. can face criminal charges. Penalties can include fines up to $3,000 per violation and imprisonment for up to six months for first offenses, increasing for subsequent offenses.

- Increased Scrutiny and Audits:

- Employers found to be non-compliant may face increased scrutiny from the Department of Homeland Security (DHS) and may be subject to more frequent audits and inspections.

Best Practices

What are some of the best practices and safeguards that your dealership can adopt to help avoid any of the costly consequences mentioned above?

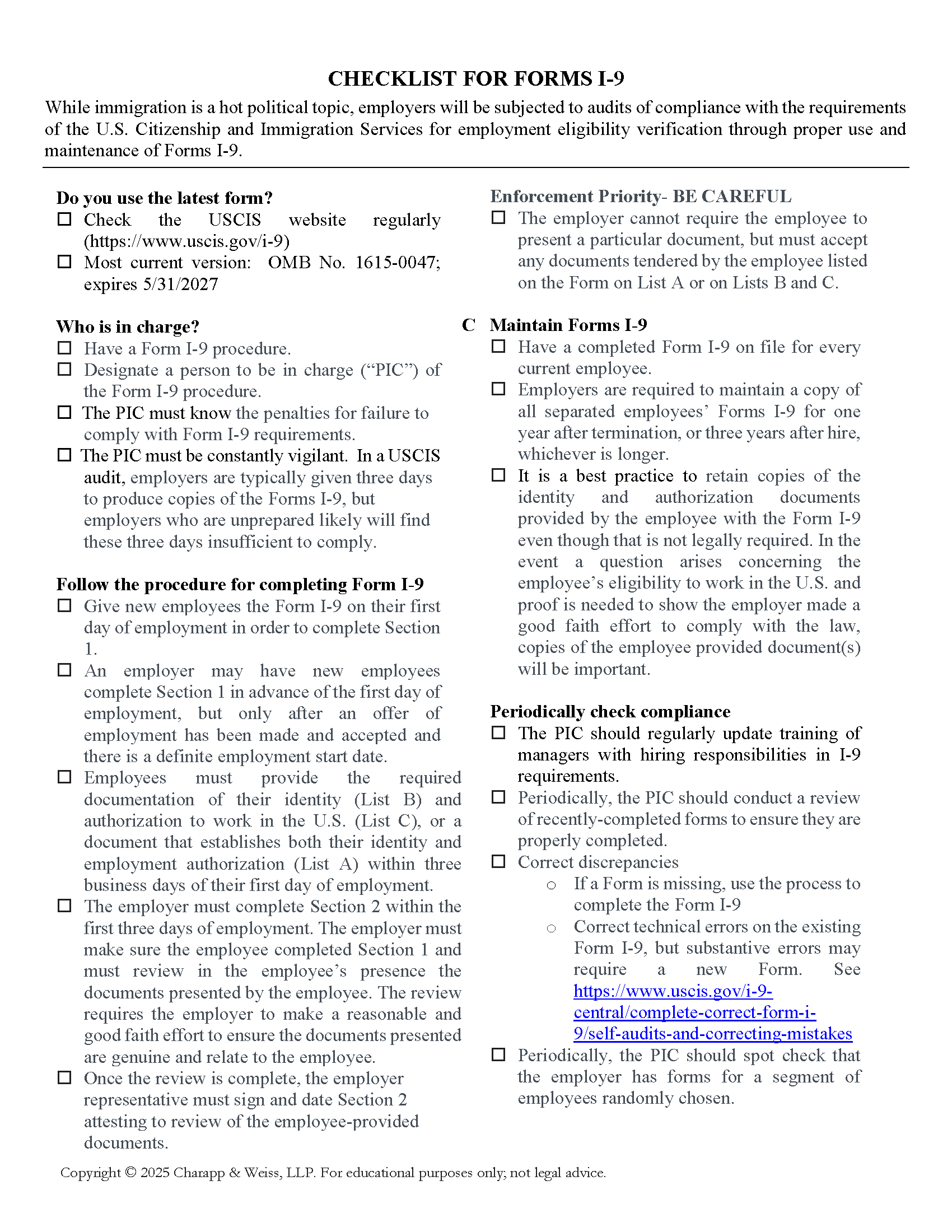

- Understand the Legal Requirements: The Immigration Reform and Control Act (IRCA) mandates that employers verify the employment eligibility of all employees hired after November 6, 1986. This requires employers to complete Form I-9 for each employee, verifying their identity and authorization to work in the United States. Familiarize yourself with the following key points on I-9s:

- Make sure that you are using the current I-9 form (https://www.uscis.gov/i-9)

- The dealership must complete a Form I-9 for every person hired within three business days of the hire.

- The employee must complete section 1 of the I-9. The regulations are crystal clear in that the employee must complete section 1. Dealers are responsible to ensure that the employee fully and properly completes section 1.

- Section 1 must be completed no later than the first day of employment. The employee may complete Section 1 in advance of the first day of employment, but only after an offer of employment has been made and accepted and there is a definite employment start date.

- Employees have the right to choose the document or documents to be provided to prove their identity and the right to work. However, Dealers are responsible for reviewing and ensuring that the document or documents provided by the employee meet the eligibility documents requirements to establish identity or employment eligibility. The eligible documents are listed on page 2 of the I-9 in three categories. Some documents establish both identity and employment eligibility (detailed on I-9 form list A). Other documents establish only identity (detailed on I-9 form list B) or only employment eligibility (detailed on I-9 form list C).

- If an employee is unable to present the required document or documents within three business days of the date of employment because the employee has applied for the appropriate documents, then the employee must present a receipt for the application within three business days. In that case, the employee must indicate, by checking the appropriate box in section 1, the eligibility to be employed in the United States. When the dealership reviews the receipt showing that the employee has applied for a document evidencing eligibility, the dealership should record the document title in section 2 of the form and write the word “receipt” and any document number in the document number space. The employee then has ninety days within which to present the actual document at which time the I-9 form should be revised to cross out the word “receipt” and insert the information about the document or documents presented.

- Retain completed I-9 forms for three years after the person’s employment begins or one year after the employment is terminated, whichever is later. For those dealers that have adopted electronic record keeping, you should have a policy for retention of the original I-9 forms either onsite or at an off-site storage facility because you will need to be able to present the forms within three business days of an inspection request.

- Develop Clear Hiring Policies and Implement Training Programs: Your dealership should have clear policies regarding the hiring of foreign nationals. You should have clear procedures for verifying work authorization, guidelines on how to handle documentation for employees with temporary work visas, and a clear stance on non-discrimination in hiring practices. Your personnel and management should be educated on immigration compliance. Regular training sessions can help ensure that those involved in the hiring process understand:

- All new employees must complete I-9s

- How to accurately complete Form I-9.

- What constitutes acceptable documentation pursuant to page 2 of the form while also reminding the staff that the employee has the right to choose what forms of identification to provide.

- The importance of non-discrimination in the hiring process, as the law protects individuals from being discriminated against based on their nationality or immigration status.

- Conduct Regular Audits: Routine internal audits of your Form I-9 records can help identify and rectify any discrepancies. Consider the following:

- Keep your I-9s in one place. If an inspector walks in, you don’t want to spend days pulling I-9s from personnel files. And you don’t want to turn over your personnel files for inspection unless you must. Make copies of all I-9s. Keep a copy in each employee’s file. Keep all original I-9s in one file that can be easily accessed if an inspection occurs.

- Take a representative sample of employees. You should have I-9s for all

- Review Documentation: Ensure all forms are completed correctly and on time, and documentation is current and valid.

- Address Errors: If errors are found, take immediate corrective actions to avoid potential penalties. If corrections are needed, you should make the changes on the original form and those changes should be dated and initialed.

- Consult Legal Expertise: Immigration laws are subject to change, and staying updated is crucial. Should you need help navigating employment law, especially as it relates to immigration law, you should seek legal advice to assist with guidance on compliance issues, specific employee situations, and any updates on legislative changes that may impact your dealership.

Conclusion

Maintaining a workforce that is fully documented for immigration purposes is essential for legal compliance and operational efficiency. By implementing the steps outlined above as well as the checklist provided in this newsletter, dealerships can mitigate risks associated with non-compliance and foster a fair and inclusive workplace. Remember, proactive measures today can save your dealership from significant legal troubles tomorrow.