June 20, 2023

By Jeff Kelley

VADA Communications

Arguably the biggest revolution to the automotive industry since mass production, the shift to EVs in the U.S. will be a slow and complicated process, a Cox Automotive executive told a group of franchise automotive dealers on Tuesday.

Cox Automotive's Brian Finkelmeyer speaks to the Virginia Automobile Dealers Association, Kentucky Automobile Dealers Association, Maryland Automobile Dealers Association, and West Virginia Automobile Dealers Association on June 20, 2023 at The Greenbrier Resort in White Sulphur Springs, West Virginia.

It’s a process “with many potholes that we’re all going to need to navigate,” Brian Finkelmeyer, executive director of Cox Automotive’s Enterprise Insights and Advisory practice, told a meeting of the Virginia, Kentucky, Maryland, and West Virginia auto dealers at their combined associations’ annual convention in White Sulphur Springs, W.Va.

The Biden administration last year announced emissions standards calling for 49 miles per gallon by 2026, a target (known as the Corporate Average Fuel Economy, or CAFE, standards) that Finkelmeyer said is impossible for automakers. “To put that in perspective, that would be like if you all asked me to get up this morning and run a four-minute mile,” he said. “I can assure you, that's not going to happen.”

The result will be financial punishment by the National Highway Traffic Safety Administration (NHTSA) for most domestic OEMs whose vehicles' MPGs will fall below the target. Automakers are charged $15 for every 0.1 MPG over the limit, multiplied by units sold, which amounts to hundreds of millions in fines.

The big winner? Tesla, which derives a significant portion of its profit from selling emissions credits to manufacturers that don’t hit the mandated goals. “Can you imagine if every dealer in this room, for every car you sold, had to send a check for $500 or $1,000 to your crosstown rival so they could build bigger facilities, hire better people, et cetera,” he said. “It’s a very difficult situation for the domestic car companies since they are essentially funding Tesla.”

At the moment, he said, the economics for EV adoption don’t add up, and he cited four “Potholes” to EV adoption in the U.S.

Pothole 1: Consumer Demand

Despite OEMs spending millions to promote EVs (with 130 new models coming in the next three years), the Tesla Model Y outsells all others combined. While inventory is often cited as a reason for lack of demand, manufacturers have a significant supply, he noted.

In reality, consumers are wary due to high cost and range concerns that create “a stressful [buying] proposition,” he said. EVs remain expensive, with an average MSRP of $61,448 that, after incentives and tax credits, average $8,370 more than an ICE.

He said consumer mindsets can only shift if prices come down, charging infrastructure improves, and range increases.

Pothole 2: Dealer Enthusiasm

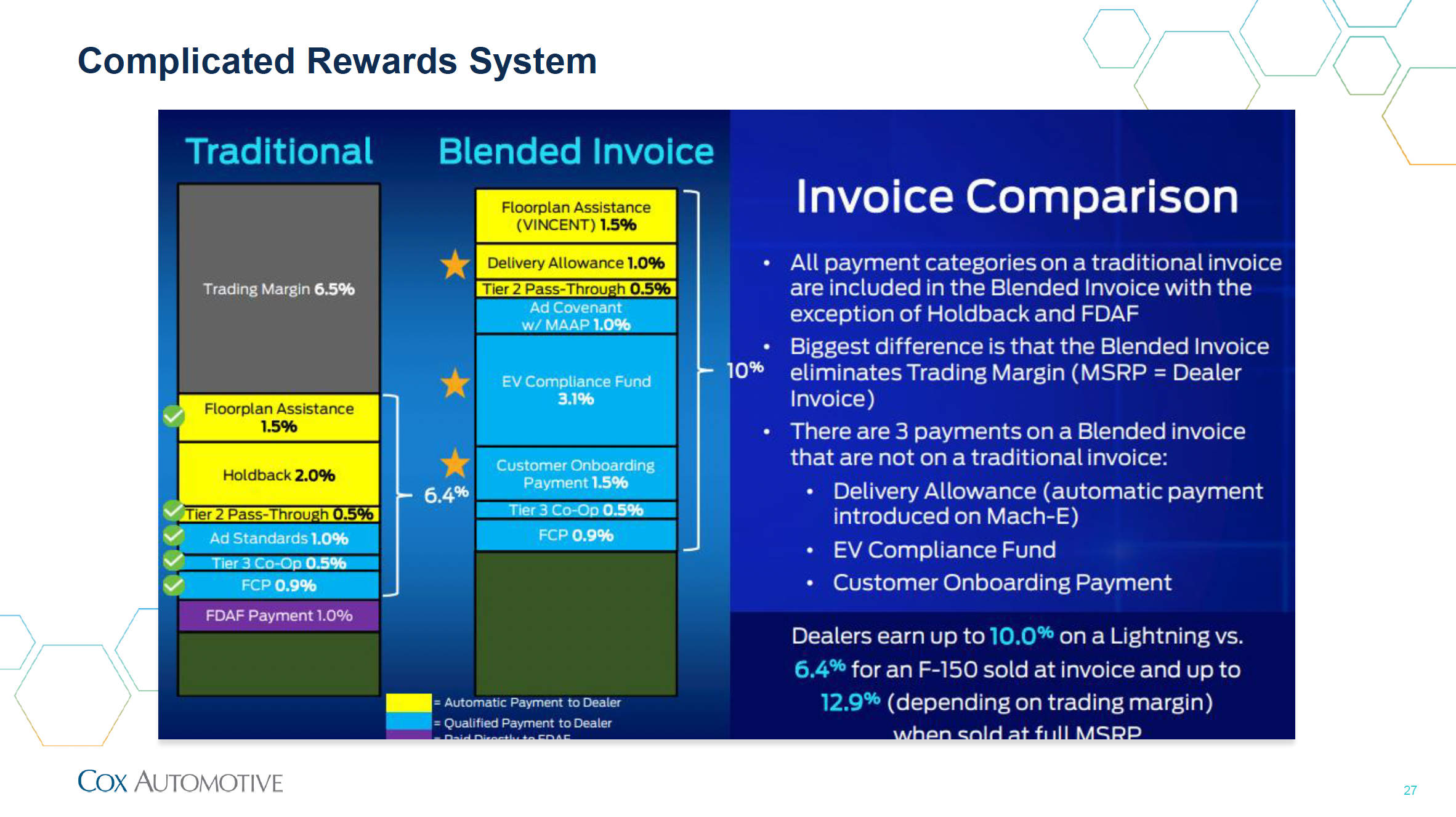

Finkelmeyer shared a slide outlining a complex "blended invoice" on the sale of an EV compared to a traditional invoice.

A Sierra Club study noted 65% of national dealers don’t have EVs on their lot — and nearly half don’t want them. Finkelmeyer said it's no surprise: Dealer rewards and incentives on invoices are complicated, and investments required are sizable. “I understand the lack of enthusiasm when you're only maybe selling a couple of these a month, yet you're out putting big money into building the infrastructure to support it,” he said.

Finkelmeyer shared good news: EVs will bring opportunities to fixed operations. Torque-heavy EVs eat tires, and require more labor even if there are fewer parts. Cox Automotive calculates the five-year projected fixed ops revenue for an EV at $4,246, just $300 less than a gasoline powertrain. “When you think about all new vehicles, all new technology...there's certainly going to be plenty of opportunity to make money in the fixed operation side of the business,” he said.

In addition, the Biden administration’s goal is to hit 67% EV adoption by 2032, a target Finkelmeyer calls “pretty ambitious.” Nevertheless, OEMs have no choice and are making significant investments in EV manufacturing, including more than $200 billion into 10 states. Virginia is not one of them.

Pothole 3: Electrical Grid

Finkelmeyer cited a Boston Consulting Group study noting that utilities may need to spend up to $5,800 per household on grid upgrades for each EV sold through 2030.

The charging network is also unreliable, he said, with one in five chargers out of order. “And that’s certainly not going to breed enthusiasm for consumers that are already nervous about [range] when they don’t feel confident about a charger,” he said. “There are massive issues that the country is going to have to work on to fix the charging situation.”

Pothole 4: Supply Chain

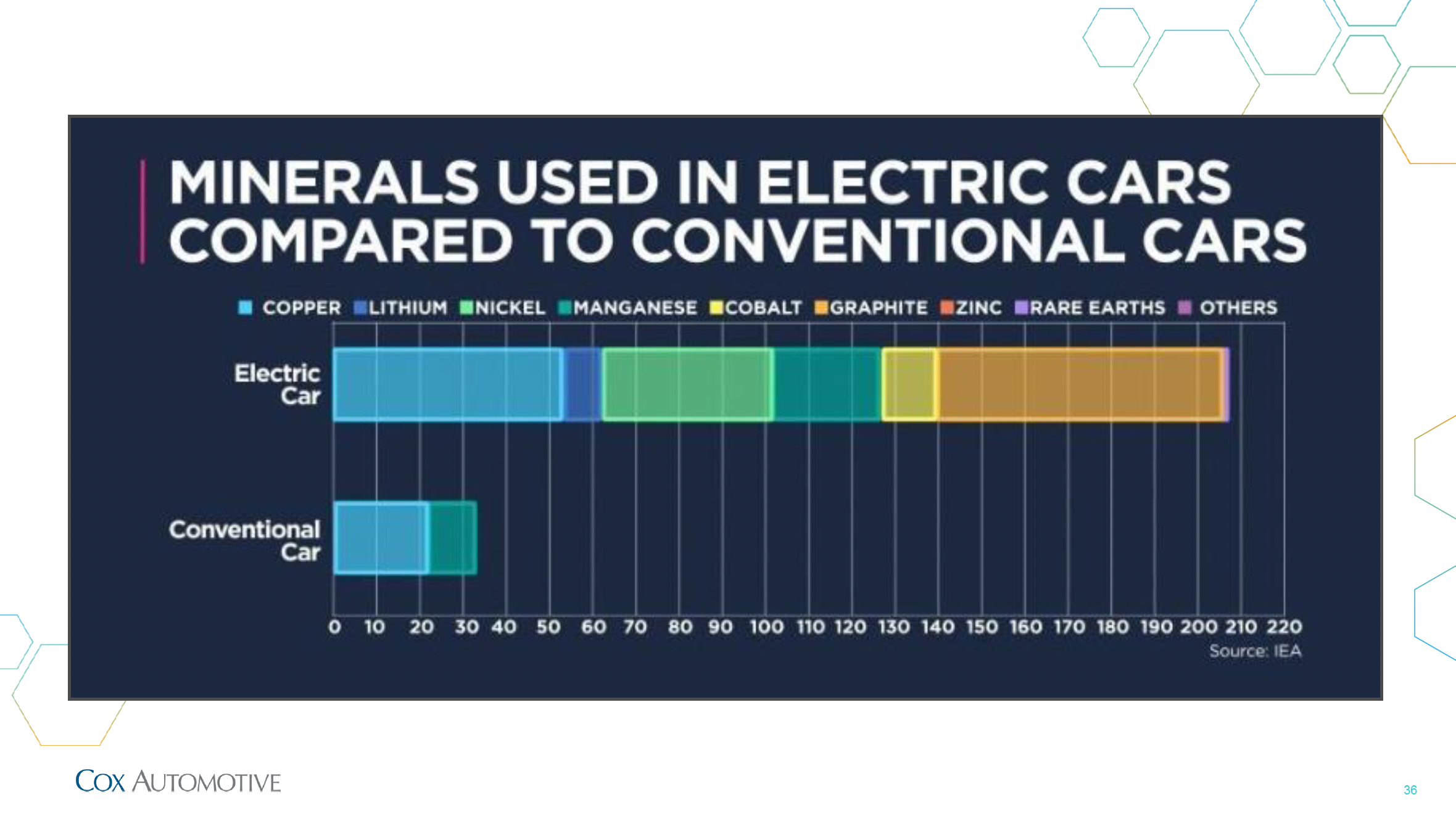

Far more raw materials go into an EV versus a traditional car or truck, Finkelmeyer said. And he noted China is well ahead of the U.S. in materials mining, component processing, and consumer adoption. In China, 33% of cars sold are electric, compared to about 5.8% in the U.S.

Far more raw materials go into an EV versus a traditional car or truck, Finkelmeyer said. And he noted China is well ahead of the U.S. in materials mining, component processing, and consumer adoption. In China, 33% of cars sold are electric, compared to about 5.8% in the U.S.

He noted the new Volvo EX30, built in China, has a highly competitive starting price of about $35,000 after a $9,000 tariff. “That's going to certainly create some pressure on the domestic car companies as [EV competition] becomes very much a global thing,” he said.

To achieve the federal government’s goals of 67% EV penetration by 2032, Finkelmeyer calculates success would require 48 million EVs on the road, and chargers must increase to 1.2 million from 53,000 — about $35 billion in additional investment. “It’s a massive amount of undertaking to make that happen,” he said.

Finkelmeyer, who had a nearly 20-year career at Nissan, said he’s come to admire competitor Toyota for its more moderate views around electrification. He showed conference-goers the “pretty darn good looking” new Prius, a hybrid starting at $27,000. He said Toyota can build 90 of the vehicles with the same amount of lithium as one all-electric vehicle battery.

And yet, despite far more minimal environmental impact, those hybrid-electric powered vehicles don’t qualify for federal incentives.

He believes U.S. lawmakers should take a more “balanced view” of emissions regulations and incentives that consider not only all-electric vehicles, but hybrids, too.

“To me, it seems like we’re going to have to use some moderation as we move towards” a future with fewer carbon emissions, Finkelmeyer said. “There’s a very interesting balancing act; we need to be thoughtful as we embark on this journey.”

Finally, Finkelmeyer encouraged dealers to embrace EVs if they want to gain an advantage, and said more manufacturers should collaborate, similar to how Ford, GM, and Rivian agreed to adopt Tesla charging networks.

“This is going to be a slow, complicated process with lots of moving parts,” he said.

But he paraphrased Winston Churchill, who said: "Americans usually get it right after they've tried everything else."

"I certainly have a lot of faith that America is going to figure this out," Finkelmeyer said. "And I also have a lot of faith that the U.S. car dealer is going to figure this out.”