Adverse action notices are not just for consumers denied credit. The Fair Credit Reporting Act (FCRA) also requires consent to run credit reports on job applicants and employees, with notification to applicants and employees if these reports lead to an adverse employment decision.

A recent action by the federal government affects the notification of adverse action in an employment setting. To understand that, let’s review how the process should work if you run a credit report on a job applicant or an employee.

- Consent for running a credit report on a job applicant or employee differs from the requirements on a consumers’ application for credit. The FAA requires that consent to run employment-related credit reports must be in writing, must be signed by the applicant or employee, and must be in a document which contains no other information. It is not enough to have the permission in an employment application.

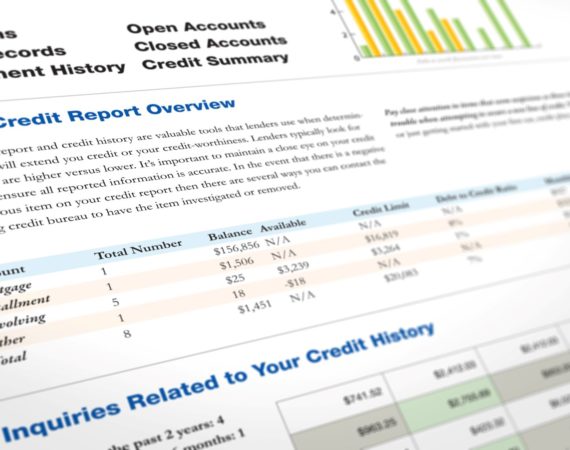

- If you obtain a report and it contains information that is a factor in your decision to not hire or promote an individual, you have obligations. Before you take the adverse action, you must give the individual a pre-adverse action disclosure that includes a copy of the individual’s credit report and a copy of “A Summary of Your Rights Under the Fair Credit Reporting Act.”

- After you have taken the adverse action (for example, rejecting the applicant), you must give an adverse action notice that gives this information: the name, address and telephone number of the credit reporting agency used; a statement that the reporting agency did not decide and it cannot explain the action; notice of the individual’s right to dispute the accuracy and completeness of any information the agency furnished; and his or her right to a free consumer report from the agency upon request within 60 days.

So what happened that changes this? Congress amended the FCRA this year to require that certain disclosures be added to the summary of consumer rights notice regarding the new security freeze rights and the change in duration for initial fraud alerts that went into effect September 21, 2018. We discussed this in last month’s newsletter.

Based on the FCRA, the feds revised the model summary of consumer rights notice. Under an interim final rule, users may use their current forms so long as they add a separate page that contains the additional required disclosures about the FCRA.

However, the best practice is for dealers to update their summary of consumer rights notice to contain the new required disclosures for security freeze rights and the change in duration for initial fraud alerts. The model form that contains the new required disclosures can be found at https://files.consumerfinance.gov/f/documents/bcfp_consumer-rights-summary_2018-09.docx.

The model Summary of Consumer Rights linked above is the form that the dealership should use for any adverse action process in an employment situation. The FTC publication Using Consumer Reports: What Employers Need to Know, provides valuable information on the adverse action process in employment.