Updated May 3, 2025

NADA issues compliance alert for pricing guidelines and inventory surrounding new federal tariffs.

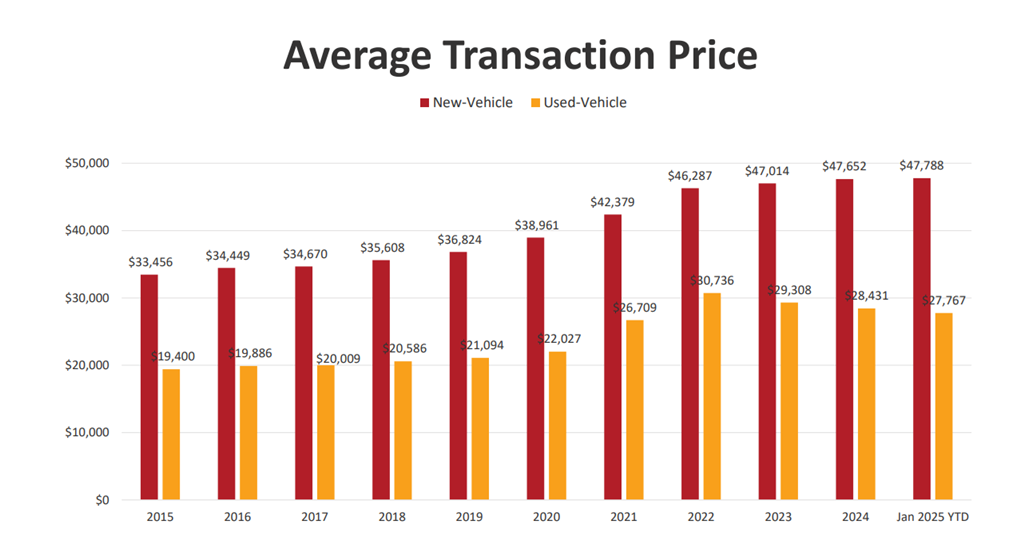

UPDATE MAY 3, 2025: The new and used automotive market is now facing market conditions not seen since the pandemic, as new auto tariffs on foreign imports are in effect.

BOTTOM LINE: With new 25% tariffs on imported finished vehicles (effective April 3) and key automotive parts (effective May 3) now in place, dealers face immediate cost increases of up to $12,000 per unit on high-import models, and an expected 5% average new vehicle price hike by year-end.

Tariff Cheat Sheet (Why costs just jumped):

| Item | Duty Rate | Effective | Fine Print |

| Finished vehicles built outside the 50 states | 25% | Apr 3, 2025 |

Applies to all passenger vehicles and light trucks, regardless of country (Source: The White House).

|

| Engines, transmissions, driveline & major electrical/safety parts | 25% | May 3, 2025 |

Temporarily exempt if the part qualifies under USMCA; CBP tracing system still in the works (Source: CBP).

|

Anderson Economic Group estimates the potential cost impact could be up to $12,000 per unit for high import models (Source: Business Insider)

Price & Volume Outlook:

- Expect an average new vehicle price increase of approximately 5% (around $2,300) by year-end.

- A corresponding 8% drop in retail sales is anticipated as "sticker shock" sets in.

- Luxury European brands and import-heavy lineups are expected to be most affected.

- The short-term demand surge seen in April (the "bank run" effect) is quickly diminishing.

Who's Safer? The 2024 American-Made Top 10

Based on Cars.com American-Made Index (considering assembly, parts, engine, and transmission origin):

Tesla Model Y | Honda Passport | VW ID.4 | Tesla Model S | Honda Odyssey | Honda Ridgeline | Toyota Camry | Jeep Gladiator | Tesla Model X | Lexus TX

OEM Moves to Cut Exposure

- Hyundai/Kia: Investing $21 billion in the U.S., including a $5.8 billion steel plant. Their Georgia "Metaplant" is ramping up to produce 300,000 EVs annually (Source: Reuters).

- Honda: Shifted production of the next-gen Civic Hybrid from Mexico to Indian to avoid duties (Source: Reuters)

- GM: Evaluating a $4-5 billion tariff bill and accelerating truck output at their Fort Wayne plant (Source: WSJ).

Dealer FAQ (What your peers are asking)

- When will I see the parts cost spike? Orders landing after May 3 will clear customs with the 25% duty unless the SKU has valid USMCA documentation.

- Will the OEMs price protect me? Ford & Stellantis have issued 60-day programs; however, most import brands have remained silent so far.

- Should I shift allocation? Yes, prioritize U.S.-built nameplates and focus on used domestic vehicles until pricing stabilizes, expected in Q4 2025.

- Blue sky impact? Aggregated industry surveys indicate a 0.3-0.5x multiple compression on import-centric groups, while domestic-heavy stores are holding steady.

- Fixed-ops hit? Expect a 1.4-1.8 percentage point squeeze in parts Gross Profit unless menu prices are adjusted by July.

Action Items for Dealers:

- Audit parts sourcing: Identify high-volume SKUs now subject to the new duty.

- Re-price menus: Adjust service menus before Q3 to protect service gross.

- Highlight U.S. content: Utilize this information in advertising and F&I conversations.

- Stress-test valuations: Revise 2025 forecasts, factoring in a 3-5% tariff drag.

- Start buyer dialogues early: Sellers with import-heavy inventory may look for exist before multiples decline further.

APRIL 30 UPDATE Bottom line: Exercise caution in communicating a price for a vehicle in a way that links the price to the imposition of tariffs. For example, dealers should not state that a particular portion of a vehicle’s price is attributable to a tariff paid on that vehicle unless that fact is known by the dealer to be true.

UPDATE APRIL 30, 2025: VADA has learned that at least one manufacturer has notified dealers they will add the tariff amount to the dealer invoice, but keep the MSRP the same. According to our information, this will make the invoice and MSRP almost equal.

The clear implication is that dealers could simply add a supplemental amount to MSRP to make up their margin. But the OEM's approach of essentially dumping the tariff onto the dealer's lap is troubling.

We share NADA's concern that dealers take great care related to price advertising and tariffs. This is particularly the case where the manufacturer is simply adding the tariff on the invoice – making it likely that a dealer could add an amount on MSRP and describe the new price as related to the tariff.

Even if the dealer's advertising does not run afoul of this advice, the dealer may still be forced to explain to the customer why the price offered is above MSRP.

We will continue to monitor developments to continue to serve as a resource for our dealers. Do not hesitate to reach out with information or questions.

What’s new: The new and used automotive market could soon experience market conditions not seen since the pandemic. According to the Center for Automotive Research, the auto tariffs on foreign imports will increase U.S. automakers’ costs by an estimated $108 billion in 2025. This could be due to direct OEM pricing actions, increased demand for non-affected vehicles, or a reduction of the supply of vehicles at pre-tariff MSRPs.

The U.S. is going to have one of the highest average tariff rates in the world based on calculation that has no basis in any economic theory, according to Patrick Manzi, chief economist at the National Automobile Dealers Association (NADA), who spoke at this month's Finished Vehicle Logistics North America conference. Those tariffs are going to impact average household disposable income in the U.S. by $3,800, with lower income households hit hardest.

When pricing vehicles: There can be potential legal and regulatory pitfalls when higher vehicle prices are advertised to consumers, particularly if an advertisement attributes the higher prices to specific causes, such as the government’s imposition of tariffs. This does not mean that dealers cannot adjust the prices of their vehicles in response to market conditions and advertise their new prices — but they should be cautious when advertising new prices and, if they chose, when attributing price increases to specific causes.

The Federal Trade Commission Chairman recently stated that the agency will watch companies closely if there is any price fixing among competitors or unlawful behavior on pricing due to tariffs.

The Federal Trade Commission Chairman recently stated that the agency will watch companies closely if there is any price fixing among competitors or unlawful behavior on pricing due to tariffs.

Here's what you CAN do: Dealers are free to set and advertise prices for new or used vehicles at whatever level they believe the market dictates, provided that such pricing complies with applicable law as well as any contractual obligations and restrictions. Dealers should consult an attorney familiar with federal, state and local law to ensure all advertisements are legally sufficient. And, of course, competing dealers should always set their prices independently and not through coordination with other dealers.

The Feds say: The FTC considers the definition of “advertisement” to be very broad and includes commercial messages in any medium. This definition encompasses much more than print, website, or online advertisements; indeed, social media, text messages, e-mails, and other forms of communication could all be considered advertisements.

As a result, dealers should exercise caution in communicating a price for a vehicle in any format or circumstance that links that price to the imposition of tariffs. For example, a dealer should not state that a particular portion of a vehicle’s price is attributable to a tariff paid on that vehicle unless that fact is known by the dealer to be true.

Related: The FTC has focused on in recent enforcement actions is misrepresenting vehicle prices in advertisements by advertising a low vehicle price and later adding previously undisclosed fees as a customer goes through the buying process.

Dealers are also reminded to not coordinate with each other regarding any aspect of how they price the vehicles they offer for sale and should not agree either (1) to add a standard price increase to vehicles due to tariffs or (2) to include a standard gross profit on vehicle sales. These actions are anticompetitive practices prohibited by law.

What’s Next: NADA is presenting a webinar, Complying with Federal Advertising Laws at Your Dealership, on April 22 at 1:00 PM EDT. Register here to learn more about protecting your dealership and pricing vehicles fairly and accurately.

- Go Deeper: NADA offers a variety of compliance resources to dealers, including a Dealer Guide to Federal Advertising Requirements.