August 15, 2024

By Barrie Charapp Beaty

Charapp & Weiss, LLP

bbeaty@cwattorneys.com

Everyone is feeling the effects of high inflation and many people are living paycheck to paycheck. Due to high costs for daily life, employees, more now than ever, will be checking to confirm that they are being paid correctly. For this reason, complete and accurate pay plans are critical and describe how employees will be paid.

Pay plans can lead either to employee satisfaction or to dissatisfaction. For dissatisfied employees, lawsuits are a possibility with significant liability for the dealership. A pay plan is as significant as any other critical document in your dealership, and it should be treated as such with definitions, clear terms and conditions, and executed by the dealership and the employee.

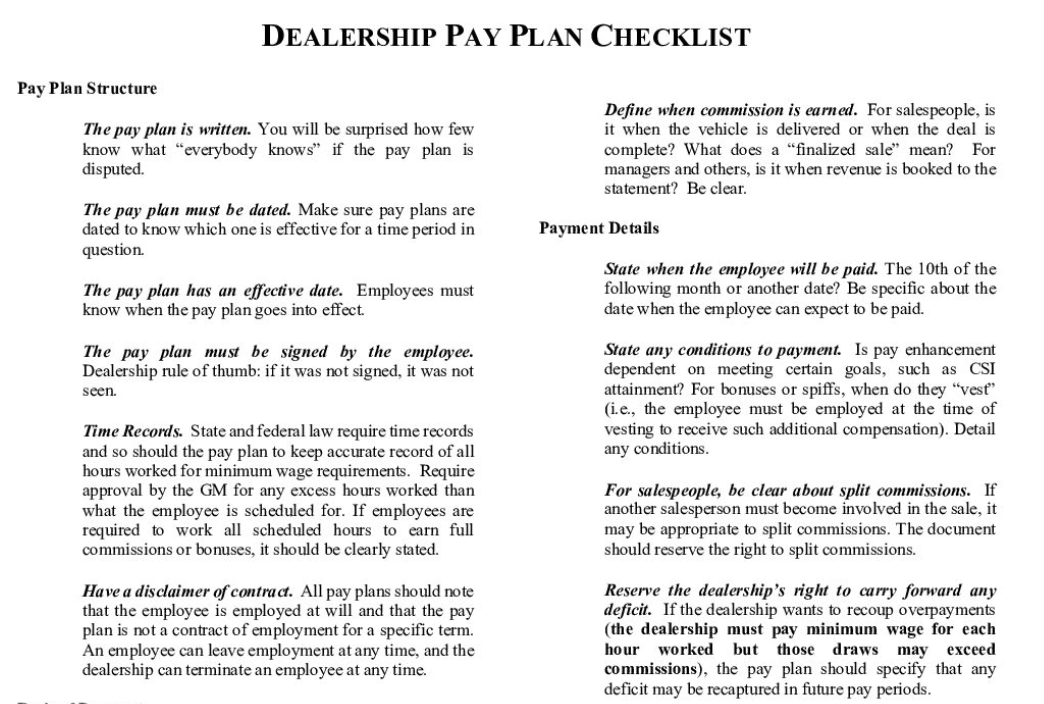

The days of pay plans on the back of a napkin are long gone, but dealers still regularly create pay plans without formality and critical items missing. There should be a standard pay plan form for each group of personnel earning commissions so that critical items are not misstated, or even forgotten. We include a checklist of pay plan terms, the purpose of which is to address deficiencies we still see in pay plans.